The US stock market had its worst day in two years. Wall Street banks were told to hand over mobile phones. Here is what you need to know.

US stocks suffered their biggest daily drop in almost two years as investors assess the impact of higher prices on earnings and prospects for monetary policy tightening on economic growth. The slump is set to continue in Japan, Australia and Hong Kong. The selloff sent the S&P 500 down 4%, the most since June 2020, with the plunge in consumer shares.

Kim may be preparing to launch an intercontinental missile or conduct a nuclear test to coincide with President Joe Biden's trip to the region, as the North Korean leader battles a Covid-19 outbreak that poses one of the greatest crises faced by his regime.

Asia's two richest men are making money from a surge in coal and oil prices caused by Russia's invasion of Ukraine. Adani is expanding a controversial mine in Australia to meet coal demand, while Ambani is snapping up distressed crude-oil cargo at discounts to feed his refining complex. Ambani's fortune increased by almost $8 billion.

Ferdinand, Bongbong, Marcos Jr., and Sara Duterte joined forces to win the Philippine election. The question now is whether they can stay united over the next six years. What could happen next, and how the Duterte family helped Marcos win by a large margin.

The Securities and Exchange Commission has been sending firms to conduct a systematic search through more than 100 personal mobile phones carried by top traders and dealmakers. They are fielding US inquiries into messaging apps. The full story can be found here.

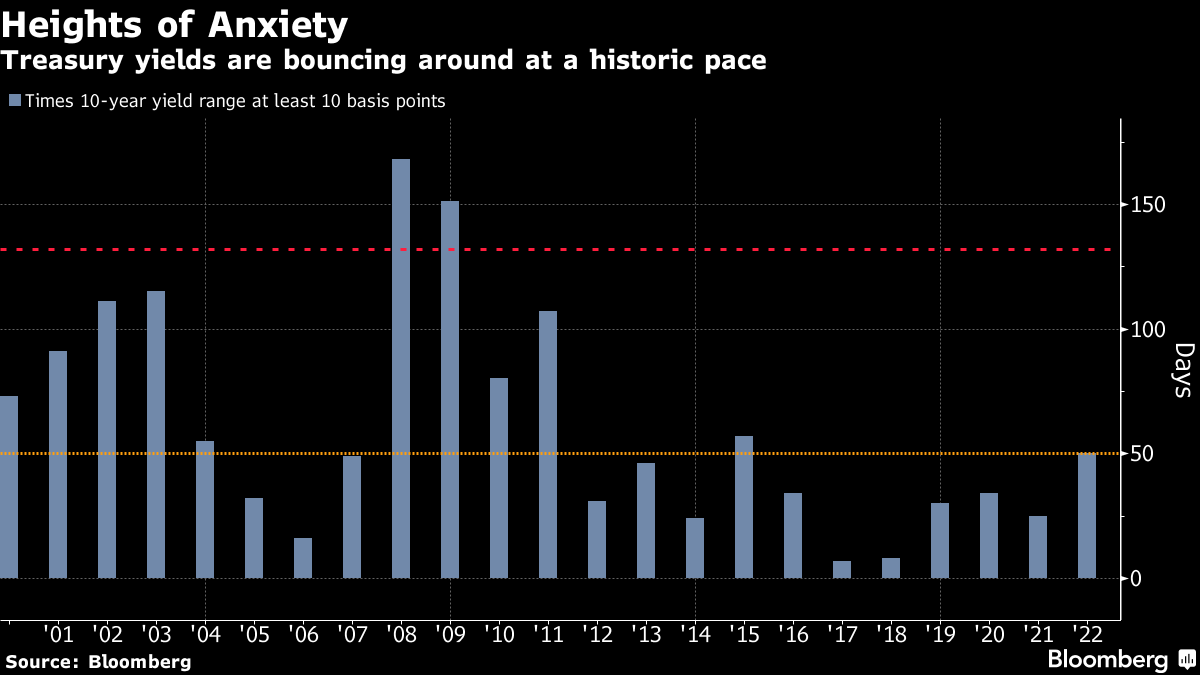

There is a lack of conviction in the way markets are changing all the time. If you think that's exaggerating, consider what's been going on in Treasuries, often cited as the world's deepest market and a potential haven for panicked investors.

The benchmark 10-year yield went up 10 basis points and then went down the same amount, as traders traded between inflation and recession fears. This sort of action is now the norm, with Wednesday marking the 50th trading day this year when the range for 10-year yield was at least 10 basis points. We are on pace for more than 130 such days, which is more than any full year since 2015. The two years that have exceeded that mark are 2008 and 2009.

Garfield Reynolds is the Chief Rates Correspondent for Bloomberg News in Asia.

With assistance by Garfield Clinton Reynolds.