everyday people feel confused by the naming schemes of the products and apps of the company The case in point is that in the year of 2022, the company decided to split the two payments into two separate ones.

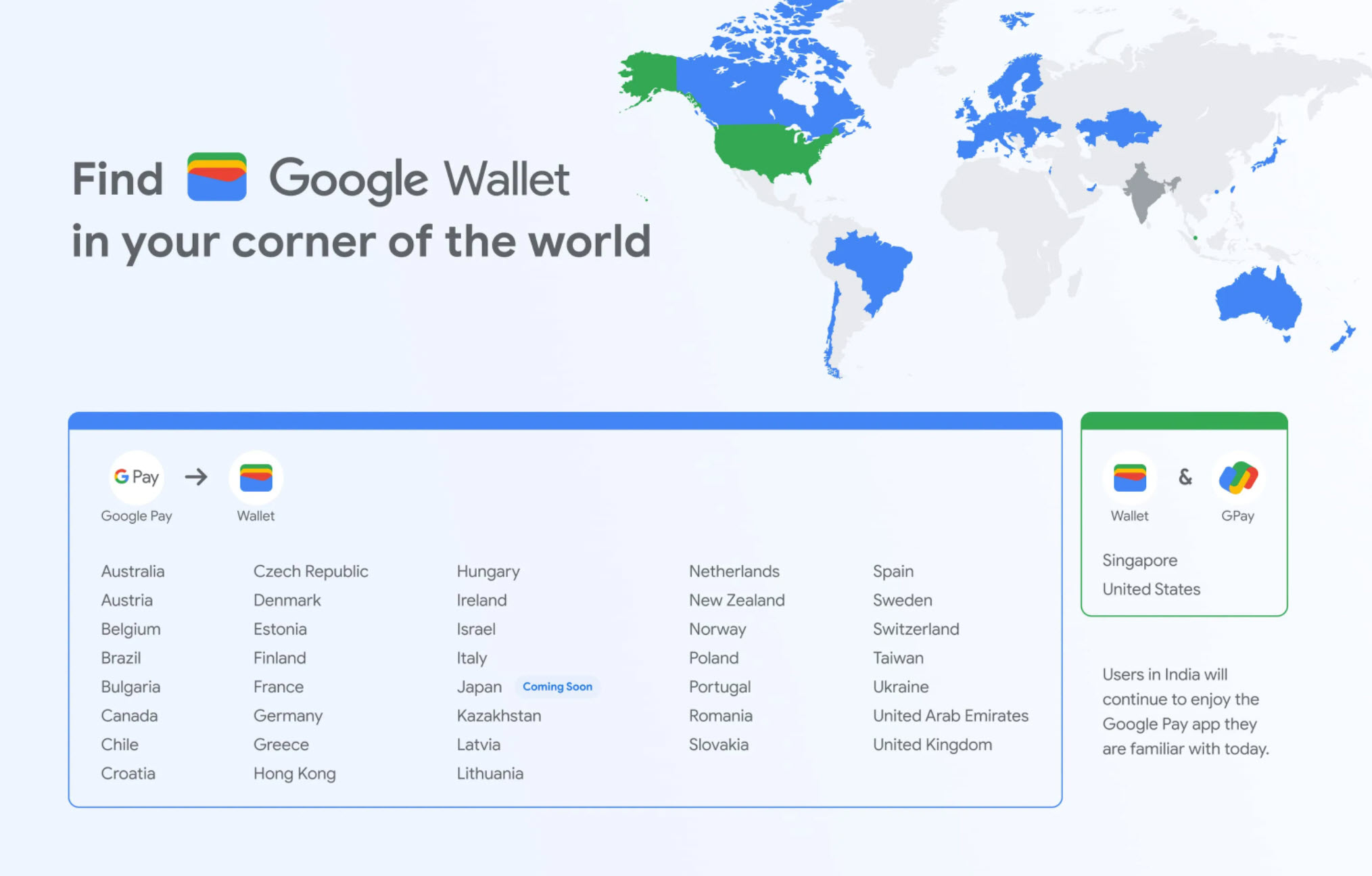

In most countries, the new Google Wallet app is the main mobile and Wear OS tool for in-store payments, boarding passes, and driver's licenses. In a few countries like the U.S., the app will only be available in a limited way. A lot of people are unsure of what has changed with the new GPay brand.

We break down the differences between the two services at the link. This post will cover the details of what, exactly, Google Pay is now that it has been restricted. We will explain where and when you can use it, and why you should use the GPay app.

An umbrella term for a payments system called GPay is available both online and in participating stores.

The second part of the GPay app is still available, and you will still be able to use it to make payments at eligible locations.

You will be able to pay for things with your phone through your watch at the Google Pay locations.

In most nations with access to the app, it will update to the new payment method fairly soon. In a few nations, the two apps will remain separate, and Pay will be used for digital payments to friends and family.

If you don't need a peer-to-peer payment app, you can use the other features you're used to using, and you don't need to use Google Pay at all. If you want to keep that feature, you can use the GPay app, which has some of the same features as wallet.

India, Singapore, and the United States are the only countries where the pay service is available.

India has its own version of GPay that will remain the same, and it won't have access to Wallet. You will still use it for making payments, but won't get access to new Wallet tools like digital IDs.

The U.S. and Singapore will have to download a new payment system, which they used before, called GPay. They can keep the Google Pay app as a concierge app, where you can do more payments-focused things like send and receive money from friends or businesses, discover offers from your favorite retailers or manage your transactions.

We haven't seen the new, devolved Google Pay yet since it is still coming soon. We can explain how the remaining features will work in the new system based on what is currently available.

The GPay payment system will allow you to quickly connect with contacts in the app. Payments can be made to your friends and family. Paying to businesses that accept GPay is the same as making payments to other businesses.

Should you wish to make payments using that method, certain apps, like Messenger, should still connect to it. Since Apple apps are the only ones that have that kind of interconnectivity, it's at least on the phones of the other manufacturers.

You can get a free transfer to and from your bank account if you wait a few days. You will have to pay a 1.5% fee if you want an instant transfer.

Even though you will use Wallet to pay at those locations, we think the Pay app will retain this feature.

You can use the app to find special offers from merchants. There can be discounts and rewards. This will allow you to save or earn when you use the pay service.

We will defer to our original guide until we know more about how Google Pay will work. It shows you how to add information and 2FA protections. You can either let friends find you via search, receive reward and cashback offers, or get store recommendations.

You can also add new payment methods to the payment system at the link provided.

Do you live in a country that supports the internet search engine? Awesome! Ensuring you can use the service is just part of the battle.

Even if you live in one of the above countries, you still need to have a bank and card that supports Google Pay before you can start making payments in stores with your phone. There's a good chance you're covered because of how long this list has been building.

Major brands like AMEX, Capital One, Chase, Discover, and Wells Fargo are all on-board with Google Pay in the U.S. The full list can be found here.

The company unveiled some new security features that will keep your financial information more secure and easier to identify.

When you use your saved cards to make online purchases, your autofilled payment details will remain hidden from storefronts. It is less likely that your real payment information will be vulnerable if a website is hacked.

Visa, AmEx, and Capital cards will be eligible for VCNs starting summer 2022, while Mastercard card VCNs will appear before the end of 2022, assuming you choose to opt in.

A series of other security changes were added to ensure websites don't get unnecessary information while you're paying for products, explained in the embedded video above.