Block executives don't want the firm to be seen as a pure play.

The company held its first investor day in five years on Wednesday, where the C-suite made their case to Wall Street that the money app, along with its other businesses, should be valued.

CFO Amrita Ahuja told CNBC in a phone interview that calling Block a payments company is like calling Amazon a bookseller.

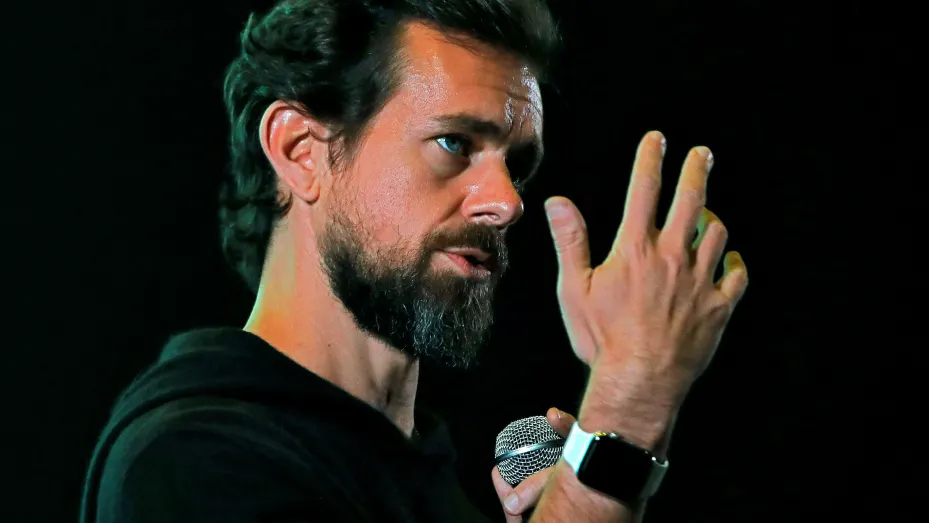

Jack Dorsey, the CEO and co-founder of the company, gave a keynote on the evolution of Block and the role it will play in the future.

A lot has changed since our last investor day.

Square made its name by creating a credit card reader for mobile phones. Peer-to-peer payments and bank-like products were added to the scope of the company. Afterpay and Jay-Z's Tidal were acquired by the firm. It offers stock and cryptocurrencies trading.

Square's corporate name change to Block was meant to reflect the widening scope of the company's plans.

Block and its peers have been hit hard by rising interest rates. The basket of fintech names is down more than 50% year to date.

Ahuja said the company is doing better than its peers on profitability. Block released updated profit margins on Wednesday as investors prioritize the bottom line over growth.

According to the company, the Square side of the business had adjusted profit margins of 34% and 12%. Cash App now has over 80 million annual actives and over 46 million monthly active users.

Wall Street analysts are going to want to understand our growth profile, and our margin structure as a company, because we are outgrowing the rest of the industry.

Block closed a $29 billion deal to buy Afterpay earlier this year as it expands into the installment loan market. The CFO highlighted the cross-selling opportunity with a small percentage of Cash App users also using AfterPay.

The lending sector has become popular with consumers and merchants. The cost of a larger purchase is spread out into four interest-free installments. Ahuja argued that it is safer than a traditional card because consumers can take additional loans if they miss a payment.

She said that people in debt spirals are skeptical of traditional forms of credit.

Jay-Z's music streaming business, Tidal, was acquired by Block for $300 million last year, at the time a head scratcher for some payment analysts. The creator economy will continue to grow as artificial intelligence removes the need for mechanical work, according to Dorsey.

This will be a massive economy in the future, and we see an opportunity to be a big part of it, using the tools and platform we have already built.

Block's gross profits were only 5% of the quarter ending in March. Block could be well positioned if executives are correct in their predictions of a secular trend in the future. It is an open standard for global money transmission and will allow Block's business to move faster around the world.

Block first started offering trading in the Cash App, and the firm holds it on the company's balance sheet as an alternative to cash. The world's largest coin is down more than 50% from its high and has struggled to regain its value.

Blocks businesses have expanded to include a hardware wallet, a mining business, and an open-source business. There is an independent business within Block called Spiral.

The internet requires a currency native to itself, and in looking at the entireecosystem of technologies to fill this role, it's clear that bitcoin is the only candidate.

The deliberateness required to preserve the attributes necessary for money storage and transmission is what makes it feel slow relative to other candidates.