The payment strategy is one of the most visible examples of this, as it is one of the reasons why Google is fond of changing its services every few years. The custom version of GPay was designed for India and was limited to a few markets.

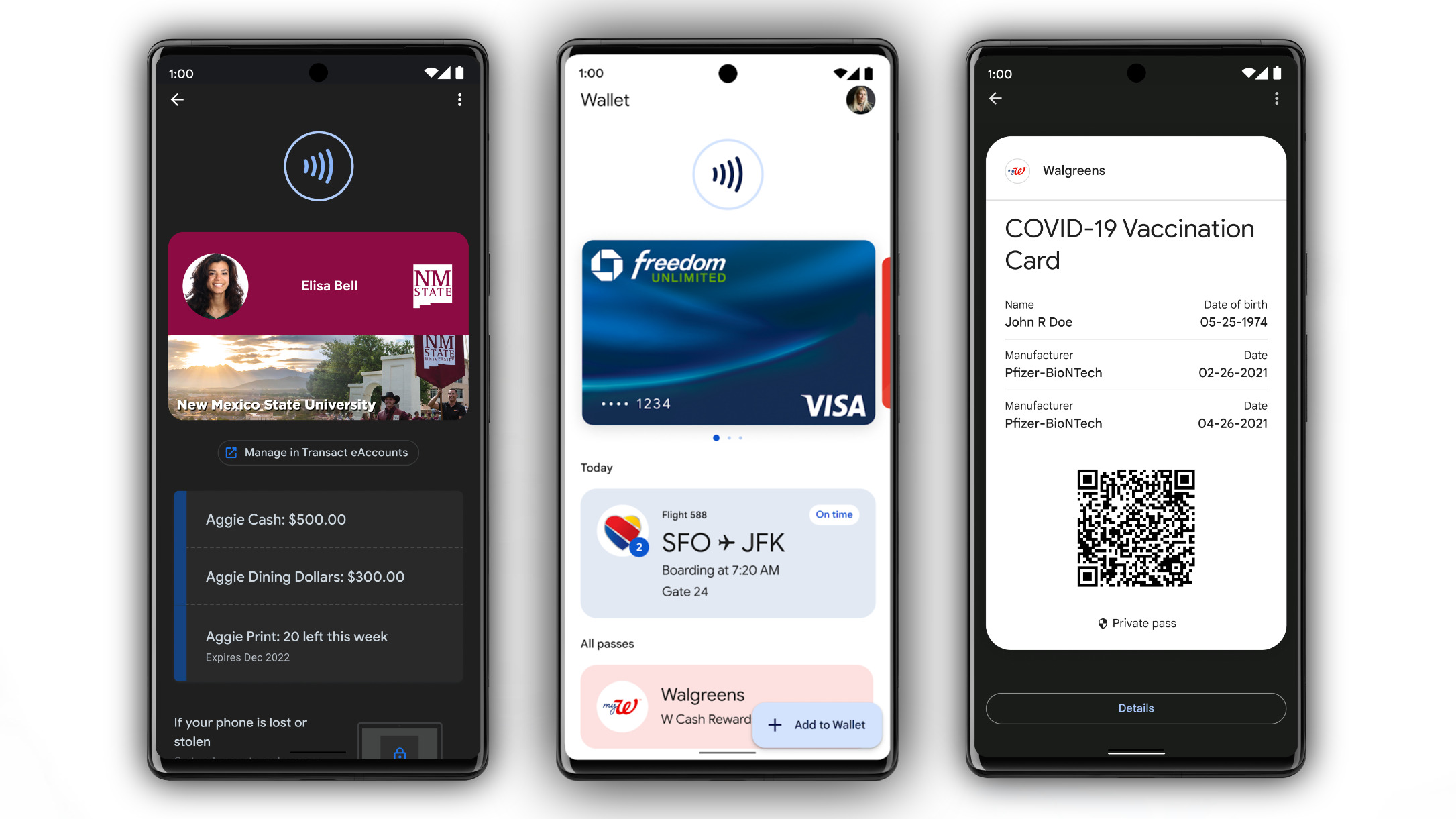

There were two different versions of Google Pay, and now there is a third product, called Google Wallet. You can pay using credit and debit cards, and you can also add digital IDs, transit cards, event tickets, car keys, and vaccine cards, with the new version of the app.

The new wallet is the latest attempt at a digital wallet that stores all of your cards securely, and it has a lot of potential. We will take a look at how we got here, what we can deliver, and why you should still care about Google Pay.

The first payment service by the company was called Wallet, but it was limited to certain devices and features. After the introduction of Android Pay in 2015, Wallet was turned into a peer-to-peer payments service. In the year 2018, there was a single service called Google Pay.

RECOMMENDED VIDEOS FOR YOU...

A brand-new payment platform designed for India was being worked on by Google India. Tez means fast in Hindi, and it was launched in 2017). The service was built to facilitate peer-to-peer payments on India's Unified Payments Interface, and it also picked up the ability to pay utility bills, view transaction history, find local businesses, and get rewards.

Google is combining Google Pay with Google Wallet.

Tez was renamed to GPay in India at the end of 2020 and then rolled out in other markets. Not all countries got the new GPay variant, and that led to two different versions of the older version that is used mostly around the world, and the GPay variant that made its way to the US.

To clear up the confusion, the older Google Pay will be merged into the new Google wallet.

You can store credit and debit cards, make payments with a credit or debit card, get rewards, and boarding passes with the ability to do so in the Google wallet.

If your car offers that feature, you will be able to use Wallet as a digital car key. It is working with states in the U.S. and international governments to bring mobile driver's licenses and the ability to store office badges directly within Wallet, and it is working with hotels to enable digital hotel keys.

It is good news for those that were affected by the transition from GPay to Wallet that the same thing will happen on Wear OS.

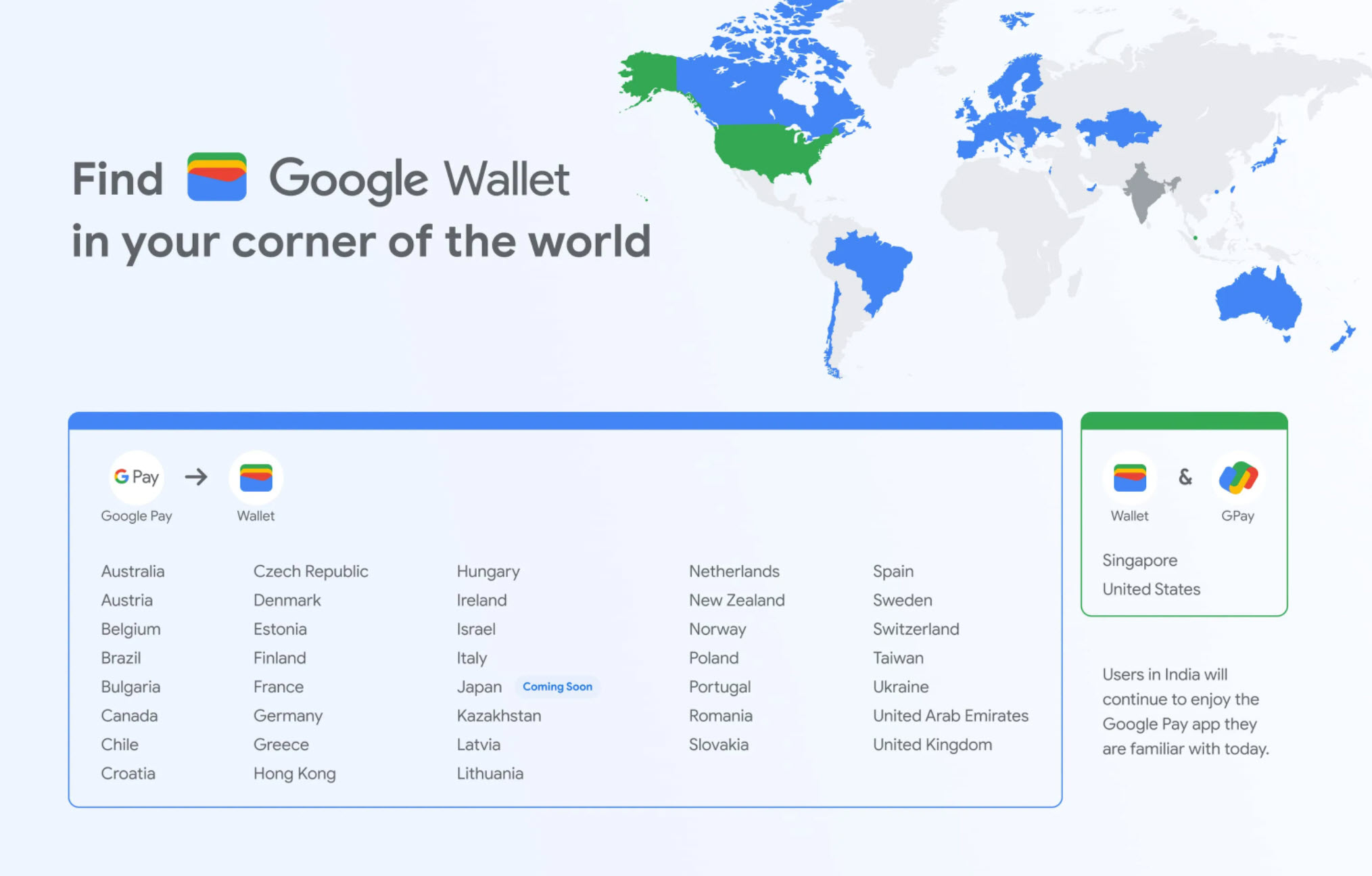

With the service set to be available in most global markets, it will become the default payments option from Google.

In 38 global markets, where it will replace Google Pay. GPay will be the default option for customers in India looking to make payments, even though the service isn't coming to India. Indian users won't be able to use digital IDs and the new features of Google wallet.

In the US and Singapore, GPay will be available with both services from Google. GPay will be an alternative to peer-to-peer payments, and will be pre-installed on the best phones going forward. If you don't need that feature, you can just use wallet.

The service itself has a lot of potential, even though it could have been made simpler.

Most of the features that were introduced in its payment services over the course of the last decade were brought together in Wallet. It is clear that the switch to Google Pay didn't have the desired effect, so this is all about course correction.

We will have more to say once it is available, but for now, you need to know that Google Pay is not going away and that Google wallet is still available in most countries.