According to Bank of America Corp.'s latest fund manager survey, investors are piling into cash as global growth optimism sinks to an all-time low.

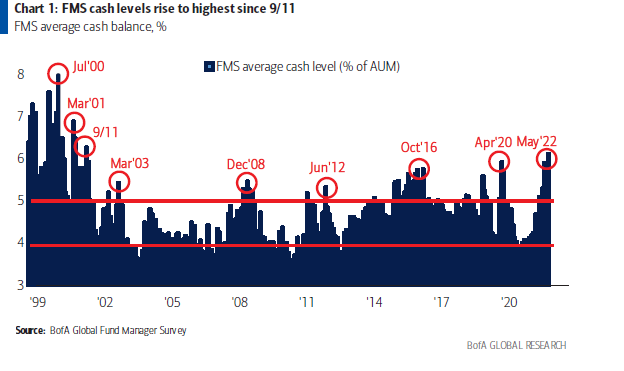

Stagflation fears were at their highest since August 2008, while cash levels among investors hit the highest level since 2001. According to BofA strategists, the biggest tail risk for investors is a global recession, followed by hawkish central banks.

The results come after the longest weekly losing streak for the world's stocks since the global financial crisis as central banks turn off the monetary taps at a time of high inflation. Morgan Stanley strategists including Michael Wilson say there will be more losses ahead as valuations get more attractive.

BofA's Michael Hartnett said that investors believe that stocks are prone to a bear market rally, but that ultimate lows have not yet been reached. The survey showed that the risks from inflation and the war in Ukraine were followed by fears of a recession. BofA's own buy signal has been triggered by the extreme bearishness.

The survey showed the biggest short in technology stocks since August. Concerns about future earnings as rates rise have caused tech shares to be particularly punished in the latest selloff.

The survey shows that investors are very long cash, commodities, healthcare and consumer staple, while being short technology, Europe and emerging markets.

With assistance from Michael Msika.