The company has 11 consecutive quarters of profits and long-term production goals. Analysts couldn't agree more about where the shares of Musk's company are going.

Their price targets for the electric-vehicle maker's stock range from a low of $250 to a high of $1,620. That is the widest gap of any company in the S&P 500. Friday was the last day of business for the company.

It is hard to value the company because it is seen as a tech company getting involved in some massive markets. The view you have is influenced by which side of the coin you fall on.

The highest price target for S&P 500 companies is more than three times greater than the lowest, according to analysts. The most bullish target on the company is more than the most pessimistic.

Investment in the stock has been driven by Musk's outsized, public personality and the coolness of the vehicles. Analysts don't know how much the company will earn in the future.

Looking to the second half of this decade and beyond, it's still difficult to model what long-term sales and earnings growth will look like. He thinks the stock will go to $1,350 in the next year.

It is not cheap. All of the big global car companies sell for less than 10 times profit, and that's because they're priced at 58 times estimated earnings for the next year.

The price-earnings multiple for all of the so-called FAANG stocks is more than 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611 888-270-6611

The expectations for future car sales that are baked into the stock price have always been ridiculous, said David Trainer, chief executive officer of research firm New Constructs, who has a sell recommendation on the stock. He said the gulf between current profits and future earnings is large.

Bulls have a history of success. Since it went public in 2010, the shares of the company have increased in value by more than 22,000%. The S&P 500 has returned 373% and averaged 15% a year.

The economic and political backdrop hasn't hurt investor enthusiasm for its stock. Ark Investment Management raised its price target for the stock last month and now expects it to more than double to $4,600 by the end of the decade.

Musk's popularity is also there. The founder and chief executive officer is not something that can be easily valued.

There are almost no other public figures who get the attention of retail investors as much as Musk.

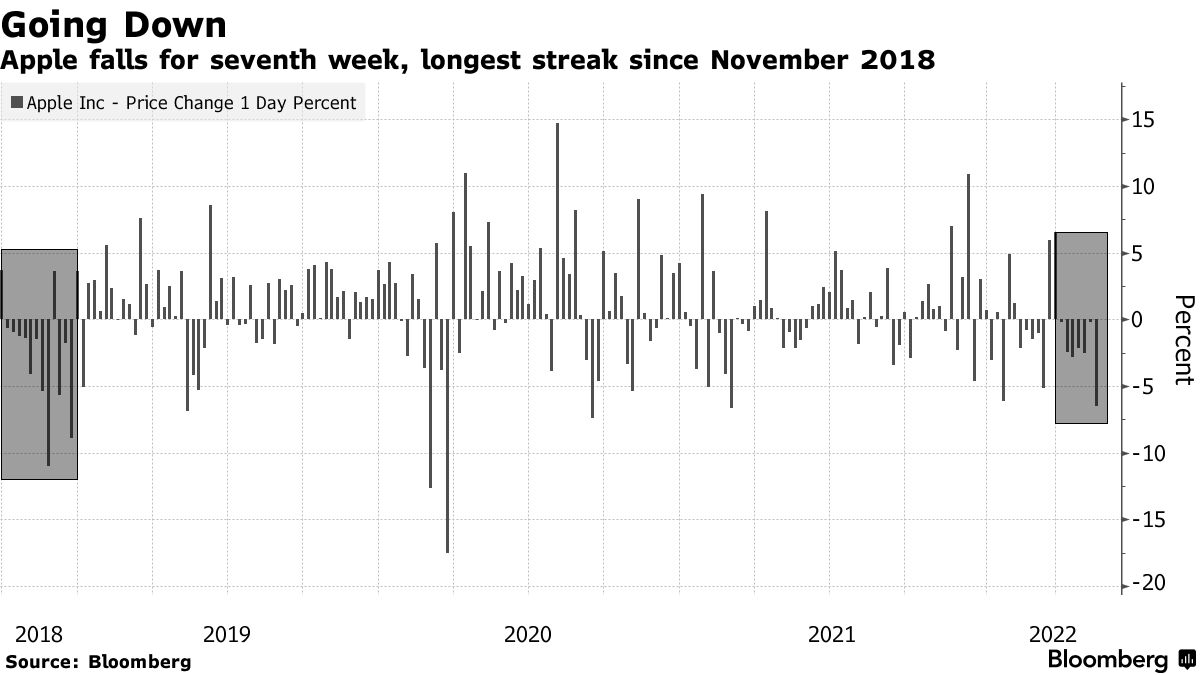

It was Apple's longest losing streak since November. The stock broke down last week, losing 6.5% in its biggest drop since February, after buoying the broader market for most of the year. The stock is down more than the S&P 500.

With assistance from Esha Dey.