On May 13, the market started off on a strong note but lost all of its gains in the last hour of trade and closed with moderate losses as banking and financial services stocks weighed down.

The Nifty50 failed to hold on to the psychological 16,000 mark, and lost 26 points to 15,782, while the BSE Sensex lost over 1,000 points from its high to close at 52,794.

The way Nifty has given up around 300 points from the high of 16,083 is indicative of a lack of conviction on the part of bulls.

The advance decline ratio was almost in favour of bulls who were able to protect the low of last Thursday's session at 15,735 levels.

The Nifty Midcap 100 and Smallcap 100 indices rose a percent each after more than two shares advanced for every share that fell on the Nifty.

The Nifty50 needs to sustain above the said low (15,735) as the breaching of this can drag down the index towards 15,400 levels where some support is visible, according to Mazhar Mohammad.

Unless Nifty manages a close above 16,000 mark for a couple of sessions, strength will not be expected.

He advised market participants to confine themselves to the fence.

There are 15 data points that we have gathered to help you spot profitable trades.

The open interest and volume data of stocks given in this story are not the current month only data.

The Nifty has key support and resistance levels.

The key support level for the Nifty is placed at 15,626. The key resistance levels to watch out for are 15,997 and 16,212.

The bank is called Nifty Bank.

Nifty Bank fell more than one percent or 411 points on Friday. The important pivot level is placed at 32,752, followed by 32,383. Key resistance levels are placed at 33,746 and 34,372 levels.

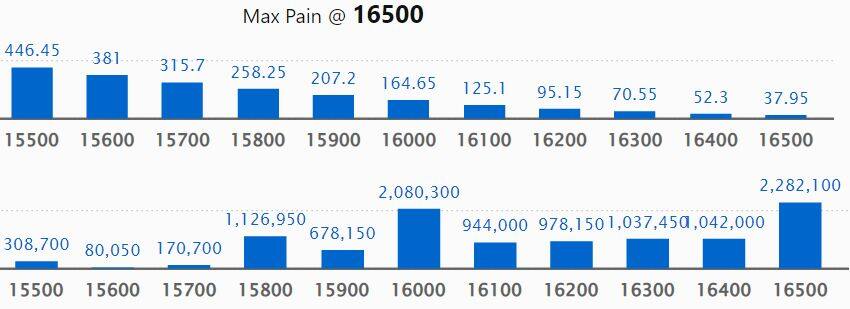

Call option data.

The maximum open interest of 36.73 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 16,000 strike, which has accumulated 20.8 lakh contracts.

Call writing was seen at 17,000 strike, which added over 1.5 million contracts, followed by 16,700 strike, which added over one million contracts, and 16,800 strike, which added 74,150 contracts.

The 16,000 strike shed over five million contracts, followed by 15,900 strike which shed over three million contracts and 16,100 strike which shed over two million contracts.

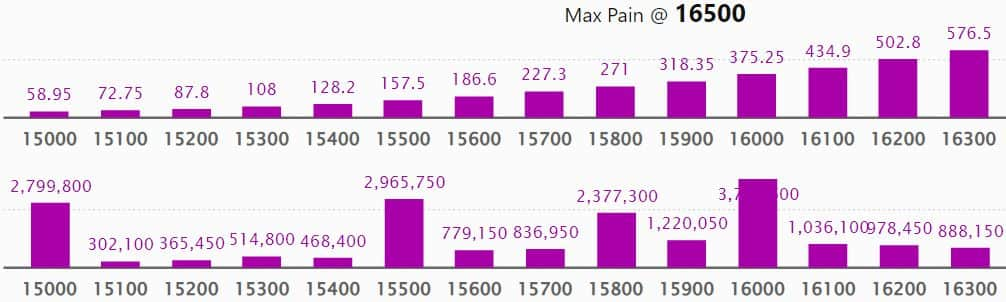

Put option data.

The maximum open interest was 37.97 lakh contracts. This is followed by 15000 strike, which has accumulated 27 million contracts.

Put writing was seen at 14,500 strike, which added 4.08 lakh contracts, followed by 15,500 strike, which added 2.49 lakh contracts, and 15,300 strike, which added 2.16 lakh contracts.

The 16,000 strike shed over 5 million contracts, followed by 16,100 strike which shed over 3 million contracts, and 15,900 strike which shed over 2 million contracts.

There are stocks with a high delivery percentage.

A high delivery percentage is indicative of investor interest. Petronet LNG, Ipca Laboratories, and M&M were some of the companies that had the highest delivery.

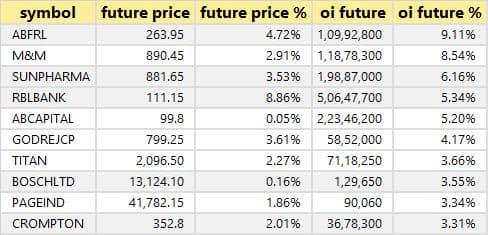

There were 42 stocks that saw long build-up.

A build-up of long positions is usually indicated by an increase in open interest and price. There was a long build-up in the top 10 stocks based on the open interest future percentage.

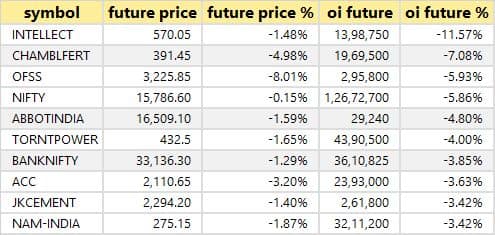

There were 42 stocks that saw long unwinding.

A decline in open interest and a decrease in price is a sign of a long unwinding. The top 10 stocks based on open interest future percentage include Intellect Design Arena, Abbott India, Oracle Financial Services Software, Nifty, and Chambal Fertilizers.

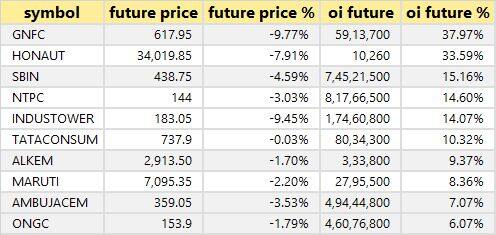

There were 59 stocks that saw short build-up.

A build-up of short positions is usually caused by an increase in open interest and a decrease in price. There was a short build-up in the top 10 stocks, which included GNFC, NTPC, and SBI, based on the open interest future percentage.

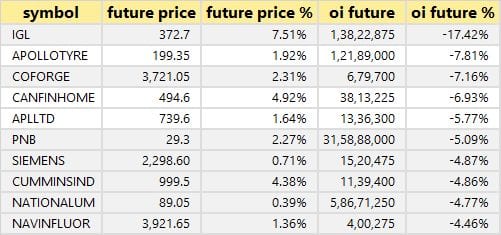

There were 56 stocks that witnessed short-covering.

A decrease in open interest along with an increase in price is a sign of a short-covering. Indraprastha Gas, Apollo Tyres, Coforge, Can Fin Homes, and Alembic Pharmaceuticals are the top 10 stocks in which short-covering was seen.

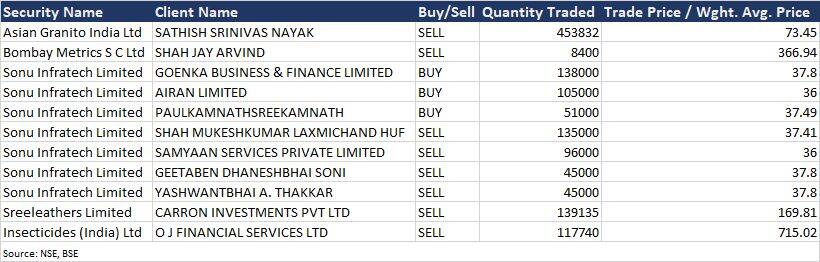

There are bulk deals.

Click here for more bulk deals.

Results on May 16.

Century Plyboards, Dodla Dairy, Fino Payments Bank, Glaxosmithkline Pharmaceuticals, Greenply Industries, Omkar Speciality Chemicals, RateGain Travel Technologies, Raymond are some of the companies.

There are stocks in news.

A net profit of Rs 1,778.77 crore was reported by Bank of Baroda for the fourth quarter of the year, as compared to a net loss of Rs 1,066.5 crore a year ago. The lender's net profit fell 19 percent on a sequential basis in the third quarter. Net interest income grew by 21.2 percent.

Tech Mahindra reported a 10 percent rise in its consolidated net profit to Rs 1,506 crore for the quarter ended March 2022, which was above analysts expectations of Rs 1,411 crore. The IT services major reported a 5.8 percent quarter-on-quarter rise in consolidated revenue from operations. In the first quarter of the year, the firm won over $1 billion in deals.

According to a statement on exchanges, the process of allocating an 800 acre site for the proposed plant of Maruti Suzuki India has been completed. In the first phase, the plans investment is more than 11,000 crores. The first plant with a manufacturing capacity of 2.5 lakh vehicles a year is expected to be commissioned by the year 2025. There will be space for more manufacturing plants at the site.

The net profit for the fourth quarter was below the average analyst estimate. The net profit for the quarter was down 24 percent against the estimates. The revenue rose 21 percent from a year ago. The firm was able to raise Rs 500 crore via securities.

The net profit for the fourth quarter was higher than the average analysts' estimates. Net profit for the quarter was up 16 percent over the year-ago period. The revenue grew by 9 percent from a year ago. The increase in average selling prices was due to a richer model mix and price hikes taken over the past few quarters. This was partially offset by a decline in volumes for Royal Enfield.

The Medicines and healthcare products Regulatory Agency has not pointed out any critical or major observations at the Taloja Plant. The company said that the MHRA has finished its inspection.

Nazara Technologies net profit fell to Rs 4.90 crore in the March quarter from Rs 17.10 crore in the same quarter a year ago. The revenue for the quarter fell by 6 percent. The firm will give its shareholders bonus shares.

Avenue Supermarts, which owns and operates retail chain D-mart, reported a 22 percent decline in its consolidated net profit for the fourth quarter. The company reported a 3 percent rise in its net profit. The revenue fell to Rs 8,787 cr from 9,218 cr. Revenue rose 19 percent.

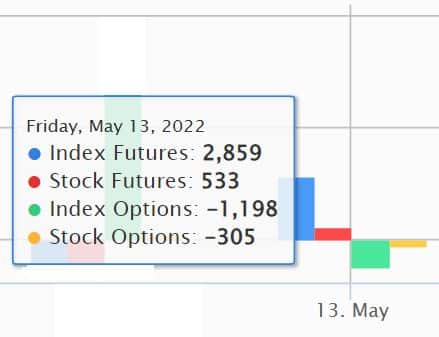

Fund flow.

DII data

Foreign institutional investors have sold shares worth Rs 3,780.08 crore, whereas domestic institutional investors have bought shares worth Rs 3,169.62 crore.

The F&O ban on the stock exchange.

The F&O ban will be in effect on May 16. The F&O segment includes companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.You can download your money calendar here and keep your dates with your moneybox.