Technicals show that there could be more punishment for the big tech Faang companies.

The group included Facebook, Amazon.com, Apple, and others. Higher interest rates have reduced the value of their future earnings gains and investors have been searching for safer assets.

The tech-laden index gained 3.7% on Friday, but is down 24% in the next four years, on course for its worst year since the global financial crisis.

Apple lost its crown as the world's most valuable company to Saudi Aramco, as all the Faangs sank toward trend lines that have historically acted as floors for the stocks.

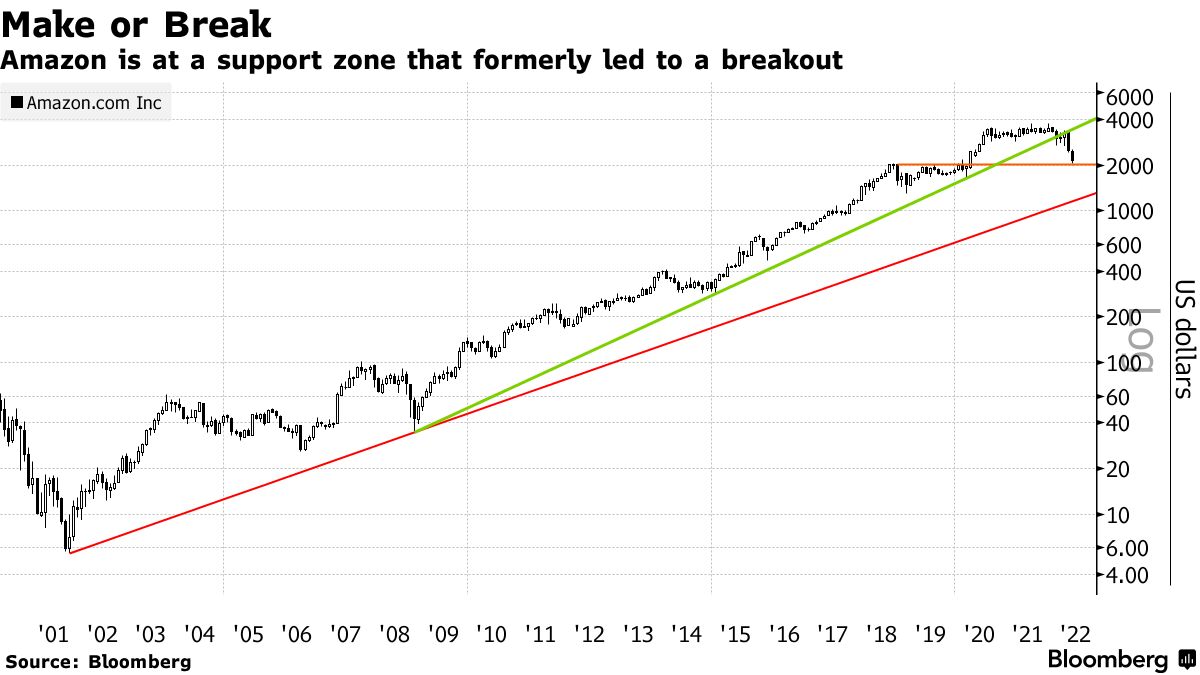

The former resistance area between $2,000 and $2,200 was close to being tested by Amazon, which had slumped 40% from its peak. The 20-year-old trend line from the 2001 low will be brought into focus if the move below this occurs.

Apple has fallen into a confluence of critical supports in the area of $140 to $150, where a trend line from September 2020 lies in close proximity to the neckline of a potential head-and-shoulders pattern. The last swing low of $150 has been broken through by the drop. The S&P 500 index is currently lagging Apple, which closed Friday at 147.11.

After topping out at the upper end of a channel drawn off the lows of the great recession of 2009, Alphabet has lost one fifth of its value this year. The decline is still within the channel's range, with prices currently trading above the median line with a so-called inverted hammer, which could be bullish. A break below the line will increase the chance of testing the edge of the lower channel. Last week, the Class C shares closed at $2,330.31.

Meta's earnings-driven plunge in February has pushed prices below a long-term trend line, which will be resistance for any bounce attempt. The stock has been supported by a short-term line of support from the lows. Meta shares closed Friday at $198.62.

The lower end of a long-term channel originated from the 2011 high is where the company is trying to hold on to. The stock failed to reach the channel highs before the recent plunge was a sign of weakness. The long-term trend line from the 2008 low will become an important marker if price falls through the channel's support area. Friday was the last day of business for the company.

Subrat Patnaik assisted.