After one of the most dramatic weeks yet for ARK Investment Management, Wall Street can no longer have doubts about the strategy being followed by Cathie Wood.

The chances of both have been questioned this year as a selloff in speculative tech stocks laid waste to her future-focused exchange-traded funds. Wednesday was the third-worst day on record for the flagship ARK Innovation Exchange Traded Fund.

One of the biggest drags that day was the largest US cryptocurrencies exchange, which plummeted 26% after disappointing results and a decline in digital assets. Wood and her team used the drop in the stock to increase holdings, adding about 860,000 shares in the week through Thursday.

It's a system that risks loading up on winners. It leaves Wood and her firm with a lot of critics. The clarity of the goal and ARK's commitment to it has won some fans.

Cathie Wood has not wavered in her conviction in her strategy, and has doubled down on her strategy, according to the president of The ETF Store.

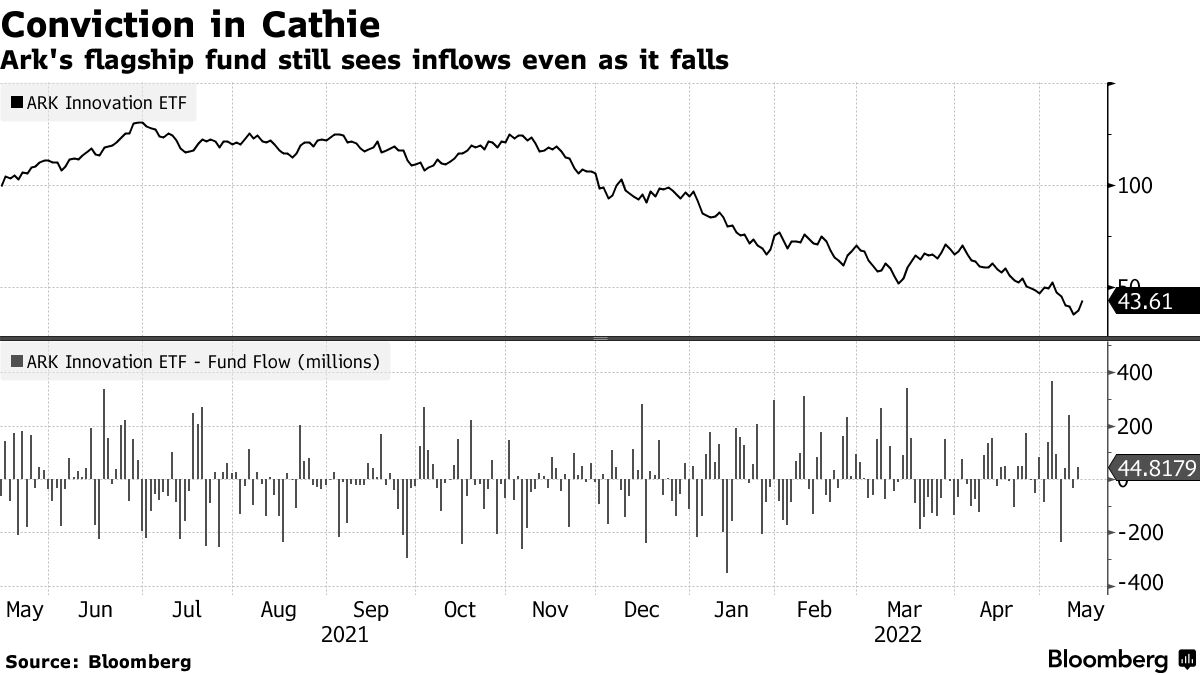

On Wednesday, it plunged, and the ARKK posted inflows. It was a relatively small amount for the $ 7.8 billion fund, but net inflow is more than 1.5 billion. That is for a vehicle that has plummeted in value.

"Investors that are in this strategy have stayed loyal to this strategy, have a long-term time horizon and view selloffs as opportunities to deploy some additional capital."

There is a lot of investors ready to bet against ARK. The main fund has a relatively elevated short interest of 14.8%.

The price of the short innovation fund by the close of Wednesday was more than double that of the long innovation fund. It costs twice as much to bet against Wood's flagship strategy for a day as it does to buy the fund itself.

By the end of the week, things were looking better for ARK as tech stocks rebounded. The fund went up 5.6% a day earlier. One of Wood's high profile picks, Robinhood Markets Inc., was surging after billionaire Sam Bankman-Fried revealed a major stake.

The fund would have to jump 260% from here to get back to its all-time high. It provides some respite for the faithful.

Ark ETFs is a vehicle to get in and out of disruptive technology. The flagship fund's trading volume surged to a record in a turbulent week.

As Ark sticks to its strategy, investors can rely on its funds to make pure-play trades on innovation.