SoftBank Group Corp.'s South Korean e-commerce company narrowed its losses after cutting costs. The company's US shares increased in value.

The operating loss narrowed in the first quarter. The company said in a statement that revenue rose 22% to $5.12 billion, while the number of active clients increased 13%.

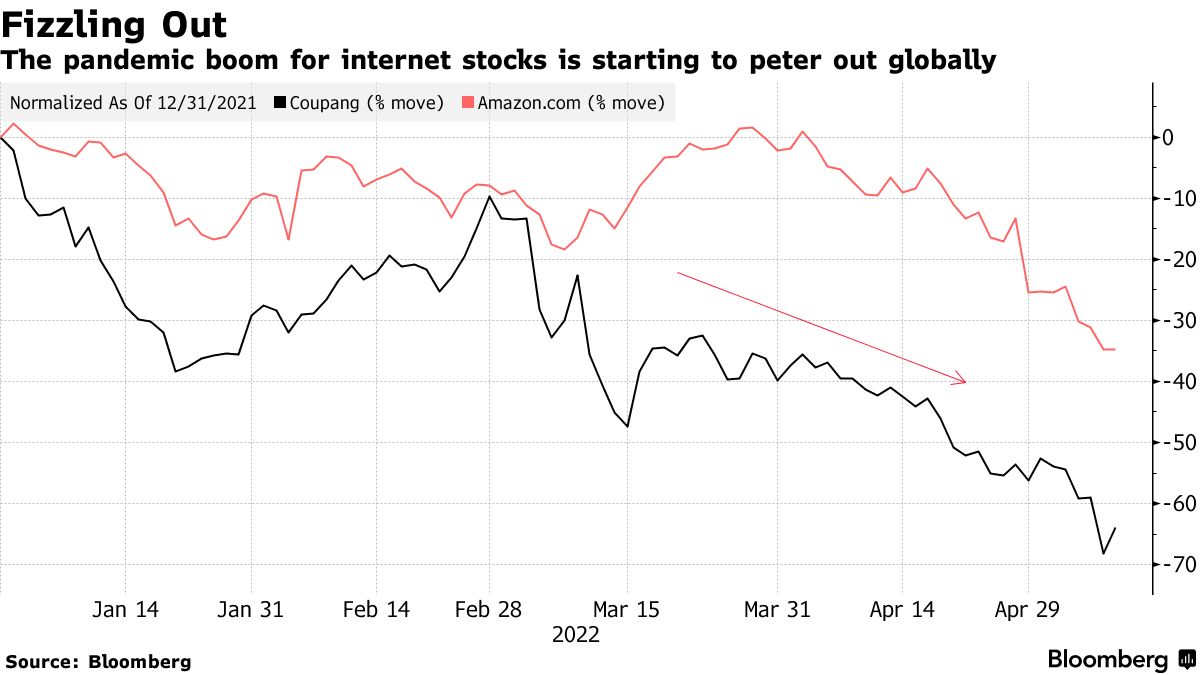

Consumers emerge from Covid-19 lockdowns or tighten their belts while the macroeconomic outlook remains uncertain. Amazon.com gave a gloomy forecast for sales last month and said it was watching inflation.

The company's sales remained relatively resilient during the first quarter as record Covid cases spurred consumers in its home country to stock up, but the focus has shifted to cost savings by increasing membership fees.

The broader tech sell-off has caused its shares to plunge. SoftBank's Vision Fund sold 50 million of the Korean company's shares in March for $20.87 each, compared with its $35 IPO price.

Park Sang-jun, an analyst at Kiwoom Securities, said that the Korean e-commerce platform companies are facing deratings globally. The market has sluggish demand but it may be able to outsell it with its dominance of commodity goods sales.