Faire, which has built a marketplace connecting retailers to independent brands globally, has raised a $416 million extension to its Series G financing, more than doubling the size of the round.

Faire is now valued at $12.59 billion post-money, or $200 million more than it was in November, according to the company. The first part of the financing was co-led by Durable Capital Partners, D1 Capital Partners and Dragoneer Investment Group.

The company raised $400 million in November of last year. Since then, it has raised an additional $196 million from Sequoia and Y Combinator, as well as another $220 million from other existing investors, taking the total raised in the Series G financing to $816 million.

Extensions are usually flat rounds. In an increasingly challenging fundraising environment, companies will choose to go the extension route as opposed to raising fresh capital as a new funding round.

We are not surprised that extensions are happening. Phil Haslett, founder and chief strategy officer of EquityZen, an online marketplace for trading pre-IPO employee shares from privately held companies, said that extensions are easier from a paperwork perspective.

If we were still in 2021, the additional capital that was raised months after the financing closed could have led to a whole new round of funding. Some companies who raised over the past 18 months or so may find that it makes more sense to perform in today's environment.

Haslett said that with extensions, you can go to existing investors and get their sign off that you're going to make the round a little bit bigger.

Faire has raised over a billion dollars since it was founded.

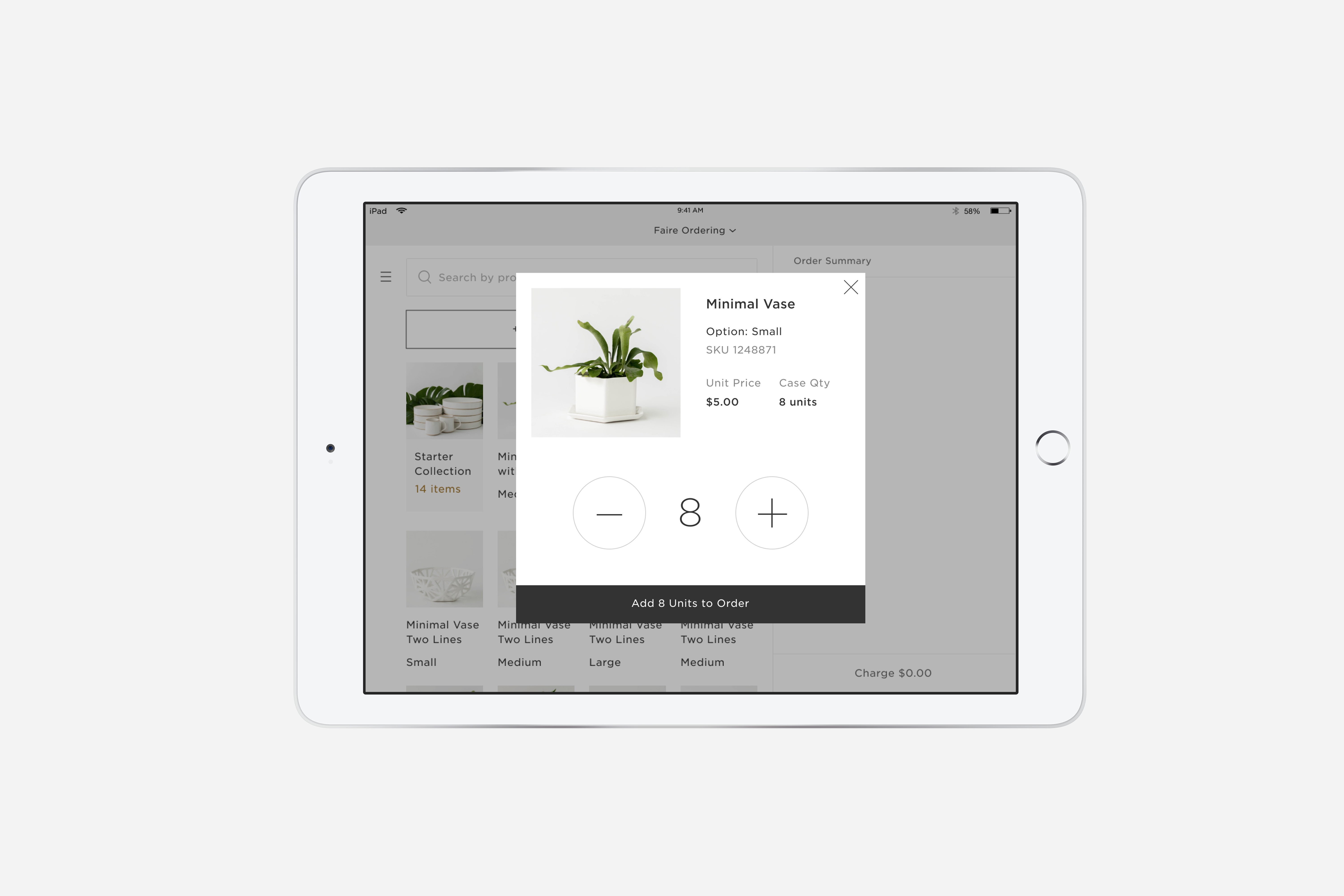

If you will, Faire's model aims to be an independent Amazon. It connects emerging independent businesses around the world with local retailers so that their goods can be sold to more people.

Faire said that it had reached more than $1 billion in annual volume in less than five years when it announced its last raise. Faire noted that six months after it expanded into 15 markets in Europe and the United Kingdom, its sales volume in the region exceeded more than $150 million, a scale that took nearly three years to achieve in North America.

According to its website, its marketplace connects over 450,000 retailers to more than 70,000 brands from over 100 countries.

Extension rounds help some startups play offense during COVID-19

The company has recently launched in Australia. The company said that the new capital will go toward global expansion, continued hiring and product development, as well as work on a product that aims to be an operating system for wholesale.

It makes sense for retailers to offer more unique products in order to increase their market share.

The image is from Faire.