Over 1,000 private companies are worth $1 billion or more to their investors. Approximately one-and-a-half unicorns are born a day. We believe that that was not always the case.

When the term was first used 10 years ago, it provided a vaunted distinction for 14 private startups that were worth $1 billion or more, but only four were added annually. It was an exceptional accomplishment and a genuine proxy for success that signaled to customers, partners, employees, and the media that this company should be taken seriously because it would likely endure.

The likes of Palantir, Square, and Square are all active in influencing how we live and work. Fab.com was one of the companies that did not stand the test of time.

Fast forward to today, and the proliferation of unicorns has gotten out of hand. Thanks to a 13-year bull market that propelled software IPO and M&A outcomes to new heights, private software valuation multiples have skyrocketed.

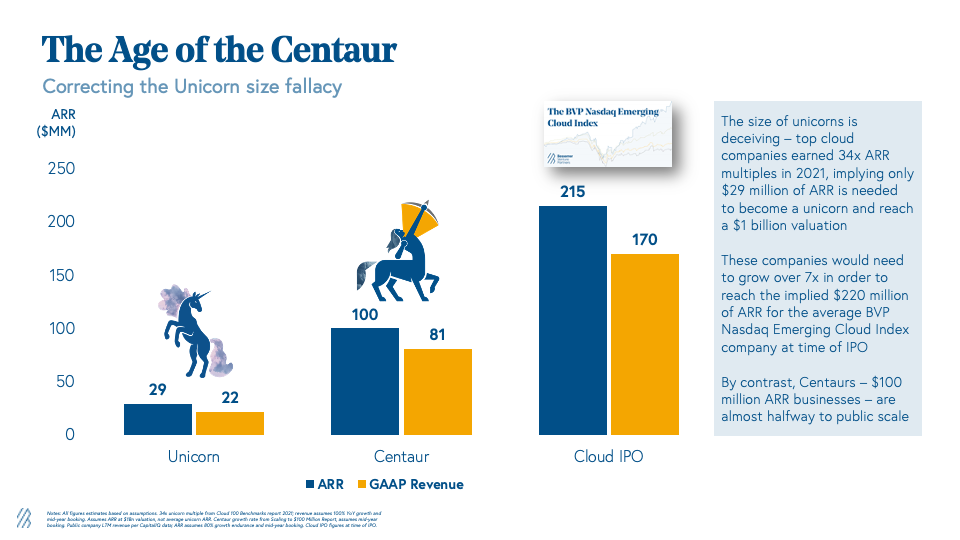

The once rare billion-dollar valuation became ordinary and inconsequential as investors rationalized a way to underwrite outcomes to 30x, 40x, 50x+ multiples. The average entry multiple for a top cloud company increased from 9x annual recurring revenue in 2016 to 34x in 2021. This dynamic has led to a misconception about the size of unicorns.

The illusion of a bigger-than-reality Unicorn can be achieved. A company only needs $29 million in ARR to become a unicorn. A 34x ARR multiple equates to a 45x current revenue multiple for a company that is growing at 100%.

Where a $1 billion valuation was once a distinction, it is now prosaic.

Private cloud companies are evaluated by ARR to reflect their rapid growth. The ARR metric overstates revenues by crediting the business with annual customer retention.

While hitting $29 million ARR is a fantastic accomplishment, the average Ltm GAAP revenue at the time of the IPO was $170 million. Many top cloud unicorns still need to grow their revenue another 7x to hit average IPO scale.

The image is from Bessemer Venture Partners.

For the last few years, investors and startups have been able to justify all of this by pointing to public market multiples. Private markets found every $1 of revenue at a top cloud business to be 4x more valuable in 2021 than in 2016 and public markets largely played along.

Do dollars become more valuable? The recent market correction suggests that they do not. The average public cloud multiple has increased to 13x from 11x over the course of the next five years. While cloud dollars are more valuable than before, they are not enough to justify the increase in private market entry prices.

With the market correction, we will see some people walking into the sunset and others being sold for slaughter. It is no longer a proxy for market leadership, quality metrics or lasting endurance for entrepreneurs and investors. The ability to raise money during the frothiest period of the last decade is the only thing we can conclude about a unicorn today.