The market fell 1.6 percent on May 6 and was under intense selling pressure in three of the four trading sessions. The sectors were caught in a bear trap. The market breadth was in favor of declines with an advance-decline ratio. Sentiment was weighed on by weak global cues.

The Nifty50 fell 271 points to 16,411, while the Nifty Midcap 100 and Smallcap 100 fell by 2% and 2% respectively.

The Nifty index formed a Doji kind of candle on the daily charts on Friday, but there was a large bearish candle formation on the weekly scale, which experts feel emphasizes the clear cut bear domination.

It bridged the bullish gap present between 16,447 and 16,418 levels, which was supposed to act as a support point. The next logical target for the index would be around 16,150 levels, according to the founder of Chartviewindia.

The market expert said that if the index fails to register a strong close above the Friday's bearish gap zone, it will be dead. He said that strength can be an opportunity to create new short positions.

There are 15 data points that we have gathered to help you spot profitable trades.

The open interest and volume data of stocks given in this story are not the current month only data.

The Nifty has key support and resistance levels.

The key support level for the Nifty is 16,340. The key resistance levels to watch out for are 16,483 and 16,555.

The bank is called Nifty Bank.

Nifty Bank was one of the key sectors that pulled the market down on Friday. The pivot level is crucial to the support of the index. Key resistance levels are placed at 34,808 and 35,025 levels.

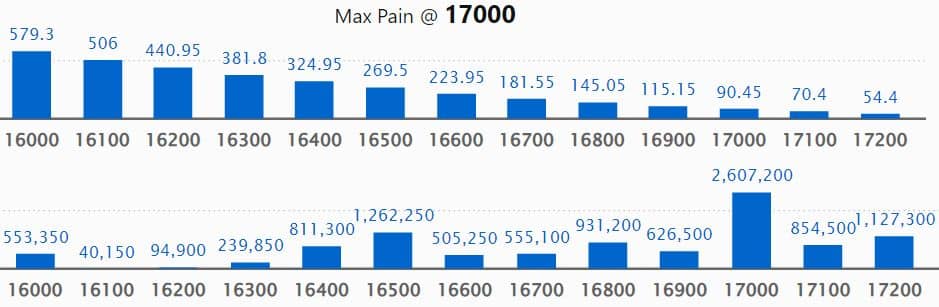

Call option data.

The maximum call open interest of 26.07 lakh contracts was seen at 17,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 17,500 strike, which holds 21.97 lakh contracts, and 18,000 strike, which has 18.98 lakh contracts.

Call writing was seen at 16,500 strike, which added 8.72 lakh contracts, followed by 16,400 strike, which added 7.72 lakh contracts, and 16,800 strike, which added 3 lakh contracts.

The 17,000 strike shed 2.17 lakh contracts, followed by 17,400 strike which shed 1.48 lakh contracts and 17,100 strike which shed 1.32 lakh contracts.

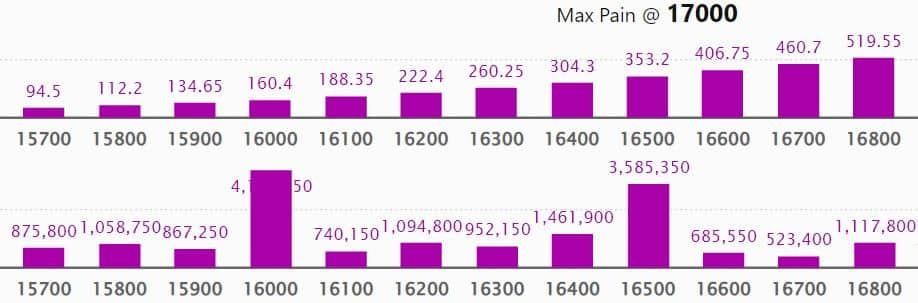

Put option data.

The maximum put open interest of 41.47 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the May series.

The 16,500 strike has 35.85 lakh contracts and the 15,500 strike has 23.43 lakh contracts.

Put writing was seen at 16,400 strike, which added 5.78 lakh contracts, followed by 16,000 strike, which added 4.36 lakh contracts, and 15,500 strike, which added 3.35 lakh contracts.

The 17,000 strike shed over five million contracts, followed by 16,500 strike which shed 2.58 million contracts, and 16,700 strike which shed 2 million contracts.

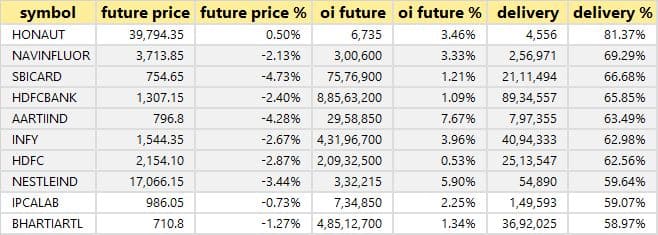

There are stocks with a high delivery percentage.

A high delivery percentage is indicative of investor interest. The highest delivery was in Navin Fluorine International.

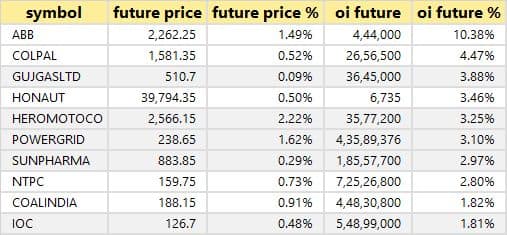

There were 12 stocks that saw long build-up.

A build-up of long positions is usually indicated by an increase in open interest and price. There was a long build-up in the top 10 stocks based on the open interest future percentage.

73 stocks had long unwindings.

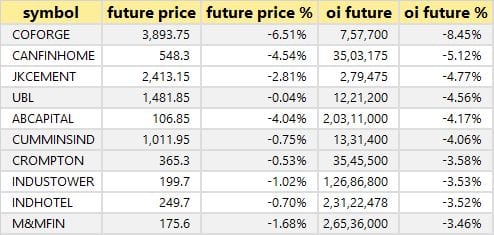

A decline in open interest and a decrease in price is a sign of a long unwinding. Here are the top 10 stocks, which had long unwinding, based on the open interest future percentage.

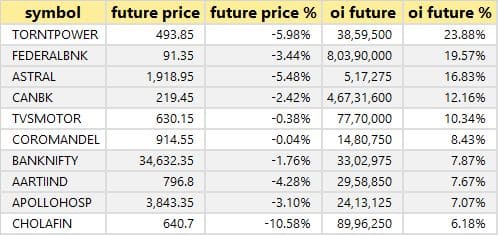

There were 99 stocks that saw short build-up.

A build-up of short positions is usually caused by an increase in open interest and a decrease in price. The top 10 stocks based on open interest future percentage are Torrent Power, Federal Bank, Astral, Canara Bank, and TVS Motor Company.

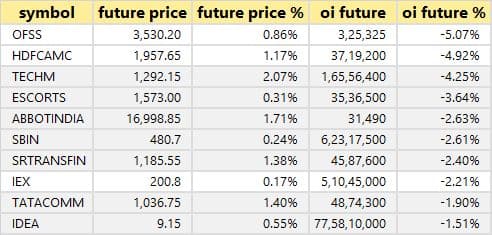

There were 16 stocks that witnessed short-covering.

A decrease in open interest along with an increase in price is a sign of a short-covering. Here are the top 10 stocks, which had short-covering seen, based on the open interest future percentage.

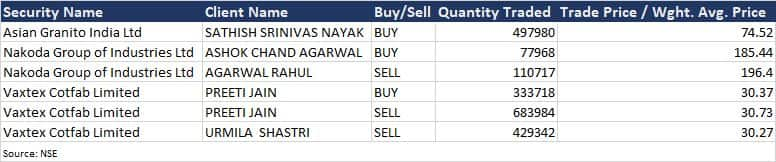

There are bulk deals.

Click here for more bulk deals.

Results on May 9.

UPL, PVR, Godrej Agrovet, Infibeam Avenues are some of the companies.

There are stocks in news.

The oil-telecom-to-retail major reported a 20.2 percent year-on-year growth in consolidated profit at Rs 18,021 crore in the quarter ended March 2022, led by strong operating income as well as topline. The company's revenue grew by 35 percent to Rs 2,32,539 crore and the company's earnings before interest, taxes, depreciation and amortization increased by 28 percent to Rs 33,968 crore in the fourth quarter of FY22.

The company will make its debut on May 9.

The IT services company has acquired a Switzerland-based digital banking and wealth management specialist for 53 million Swiss Francs. The acquisition is expected to be completed by July 1, 2022.

The Shipping Corporation of India recorded a 77.4 percent year-on-year growth in consolidated profit in the quarter ended March 2022, on strong topline and operating income. The revenue from operations grew by 50 percent.

The women's bottom-wear brand reported a 73 percent year-on-year growth in profit at Rs 12 crore in the fourth quarter of FY22, driven by healthy operating income and revenue. The revenue from operations grew by 29 percent to Rs 116 crore and the volume grew by 11 percent.

Despite higher input cost and power and fuel expenses, the company recorded a 44.5% year-on-year growth in profit at Rs 9.77 crore in the quarter ended March. Revenue grew by 33 percent in the same quarter.

The Reserve Bank of India approved the amalgamation of Equitas Small Finance Bank with Equitas Holding.

In the quarter ended March, the company reported a 31.4 percent year-on-year growth in profit. The revenue from operations increased by 15%.

India's next large-scale IT services player will be created by a merger of Mindtree and L&T Infotech. L&T Infotech will give 73 shares of its stock for every 100 shares held by Mindtree shareholders. After the merger, L&T Infotech will be held by Larsen & Toubro.

Fund flow.

DII data

On May 6, foreign institutional investors sold shares worth over five billion dollars. Domestic institutional investors remained net buyers, to the tune of Rs 3,014.85 crore worth of shares on the same day.

The F&O ban on the stock exchange.

Since the beginning of May series, the stock market has not put any stock under the F&O ban. The F&O segment includes companies in which the security has crossed 95 percent of the market-wide position limit.

The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.You can download your money calendar here and keep your dates with your moneybox.