The latest news and analysis can be found at our website.

The cost-of-living crisis is stretching affordability for property buyers in the U.K. as rising borrowing costs add to this.

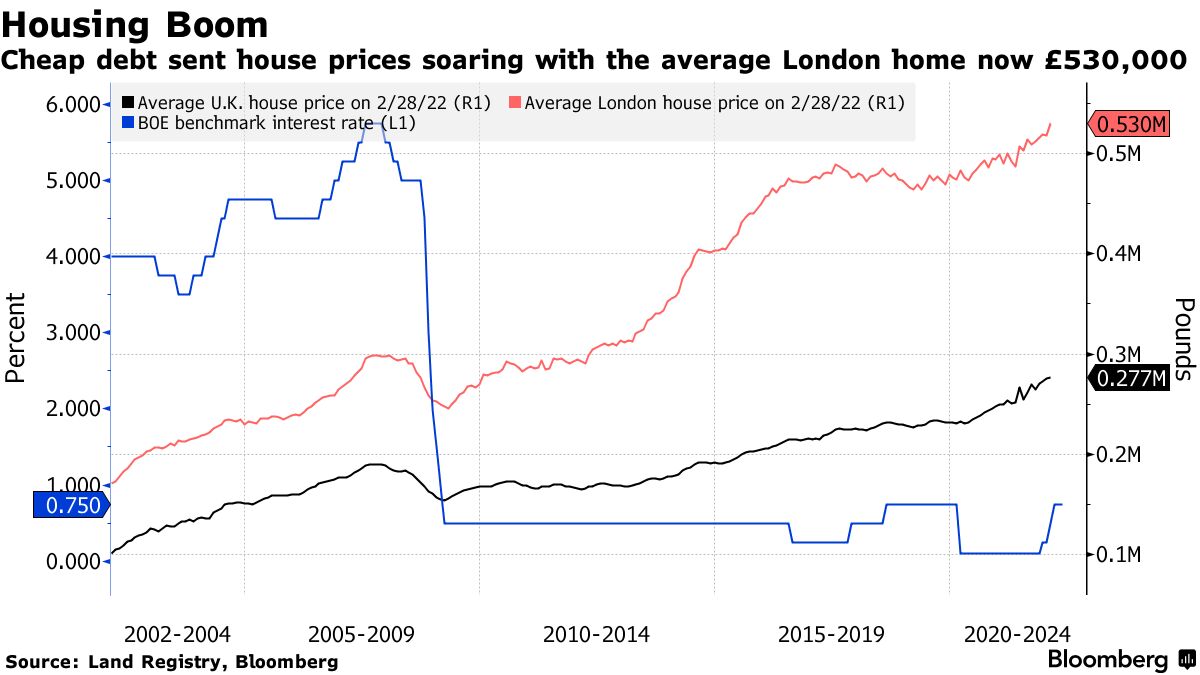

The Bank of England raised interest rates from historic lows. It's making it more expensive to own a home at a time when prices of everything from energy to clothes are suffering the worst bout of inflation since the 1980s.

Over the past few years, a shift toward fixed-rate home loans has helped cushion 80% of mortgage holders from an immediate shock. When those deals end, borrowers will be forced to pay higher rates.

The structure of the mortgage market has changed, so the speed of pass-through from policy changes into mortgage rates is a little slower than in the past. There will be some effects on the housing market from that pass-through.

The 2 million households on fixed rates are feeling the squeeze. The quarter-point increase adds more than 30 pounds a month to the mortgage payments. Rock-bottom interest rates are no longer available for new borrowers.

The U.K. central bank raised its benchmark lending rate for the fourth time since December to 1%. It warns of a growing risk of recession and double-digit inflation.

Britons are fixing for longer terms to take advantage of low rates.

The Bank of England statistics were analyzed.

That is contributing to the fact that this will be one of the worst years on record for living standards.

The pressures on the wider economy can't be ignored even after property prices rise for a 10th consecutive month, according to the latest warning from mortgage lender Halifax.

The rate of house price growth is likely to slow by the end of the year as interest rates rise and inflation increases.

Nationwide Building Society painted a similar picture, saying the squeeze on household incomes is set to intensify.

The cost of mortgage borrowing rose more than at any time in the last six years, and mortgage approvals fell sharply in March from a year earlier, according to data published in the past week.

In March, U.K. mortgage costs rose.

The Bank of England.

Property prices have risen 80% since the financial crisis because of cheap money. The average new mortgage hit a record 237,000 pounds in March.

In London, the average home is almost double the national average and raising a deposit remains the biggest obstacle to getting on the housing ladder.

Home buyers are taking on record amounts of debt.

Land registry data from the Bank of England.

While debt burdens remain steady, rising interest rates could make it harder for people to make payments.

The proportion of households losing 40% or more of their pre-tax incomes to debt-servicing costs could reach rates last seen in 2006 if rates rise to 2.5%.

The psychological impact of a rising base rate above 1%, higher mortgage rates, a cost-of-living squeeze and the gradual rebuilding of supply will all contribute to the slowdown as house prices come back down to earth later this year.

The average home in London costs more than 9 times the average salary.

The source is Nationwide.

To be sure, analysts and the Bank of England are expecting a slower pace of growth rather than a fall in prices.

The market is underpinned by a strong labor market and savings. The cost of living is falling most on low-income households, which are more likely to be rent rather than own.

Martin Beck, chief economic adviser to the economic forecasting group, said those expecting a correction in property values are likely to be disappointed.

Philip Aldrick assisted.