The German landlord of Adler Group SA made seemingly conflicting disclosures about a loan it had taken out from a subsidiary, which may have allowed the creditor to claim their money back.

At the end of December, a unit tied to Adler Real Estate borrowed 265 million euros. The company didn't tell investors about the loan until late March, when it said the loan agreement had been signed.

According to people familiar with the matter, the bondholders are seeking advice from restructuring advisers and law firms over whether that is a violation of the bond terms. The people asked not to be identified discussing internal deliberations said that some of the Adler Real Estate's creditor argued that the loan put money out of their reach.

Adler lost as much as 17% in Frankfurt.

On a call with Adler's management Tuesday, investors asked why there was a three-month gap between the dates. As of Thursday afternoon, no updates had been provided on the issue after the call, according to bondholders.

After being asked if he was involved in approving the loan agreement months after it was granted, he said on the call, "Do me a big favor and."

A representative for Adler declined to comment on the efforts by bondholders to organize and said the company was continuing to collect questions from investor calls and provide answers.

The spokesman said in an email that the information would be provided in due course.

Viceroy Research accused Adler of being effectively run by a small group of outsiders, including Austrian tycoon Cevdet Caner, for their own benefit. The landlord has sold large portions of its assets to reduce its debt pile and shore up liquidity, but its failure to disprove some of Perring's allegations through a forensic probe only accelerated a selloff in its stock and bonds.

According to some people, the company's bondholders are in talks about forming a large group to demand early repayment of the bonds if the company is in violation of debt rules. 15% of the principal amount in one case and 25% of the principal amount in another are the thresholds set by the bonds' terms.

Adler Group repaid a 300 million-euro revolving credit facility from its banks a day before the contentious loan was granted. The landlord said it used money from the divestments to repay the credit line. The asset sales were done the same day it took out the loan. The following week, Adler announced their completion.

Adler Efforts to Contain Crisis Unravel in Roller Coaster

A Controversial Tycoon Sits on Adler’s $9 Billion Pile of Debt

In Adler’s Orbit, a Set of Deals Leads to Azeri First Family

Adler Repaid Key Credit Facility After String of Asset Sales

Adler said the credit line was no longer needed because the company had enough cash. Some investors wonder why a company that only recently struggled with cash flow would give up access to such financing.

When Adler first disclosed the existence of the loan three months later, it had to correct its initial filing after understating the amount of borrowings. Adler Real Estate filed its annual accounts on April 30 and investors learned that the loan had already been given out.

The landlord's long-awaited annual results came to the fore last weekend, after the disclosure. The accounts were not endorsed by the auditor, who said Adler had not given the necessary information to assess the deals. The unusual step sent shares and bonds of the company tumbling.

Bondholders wondered if the Adler Group's result had even been audited. The company had to file audited accounts by the end of April in order to comply with the terms of its bonds. From a legal standpoint, the accounts were audited.

S&P Global Ratings lowered its credit rating on Adler on Thursday. S&P said that the company is now more reliant on asset sales to repay its next bond because of the fact that Adler has less liquidity.

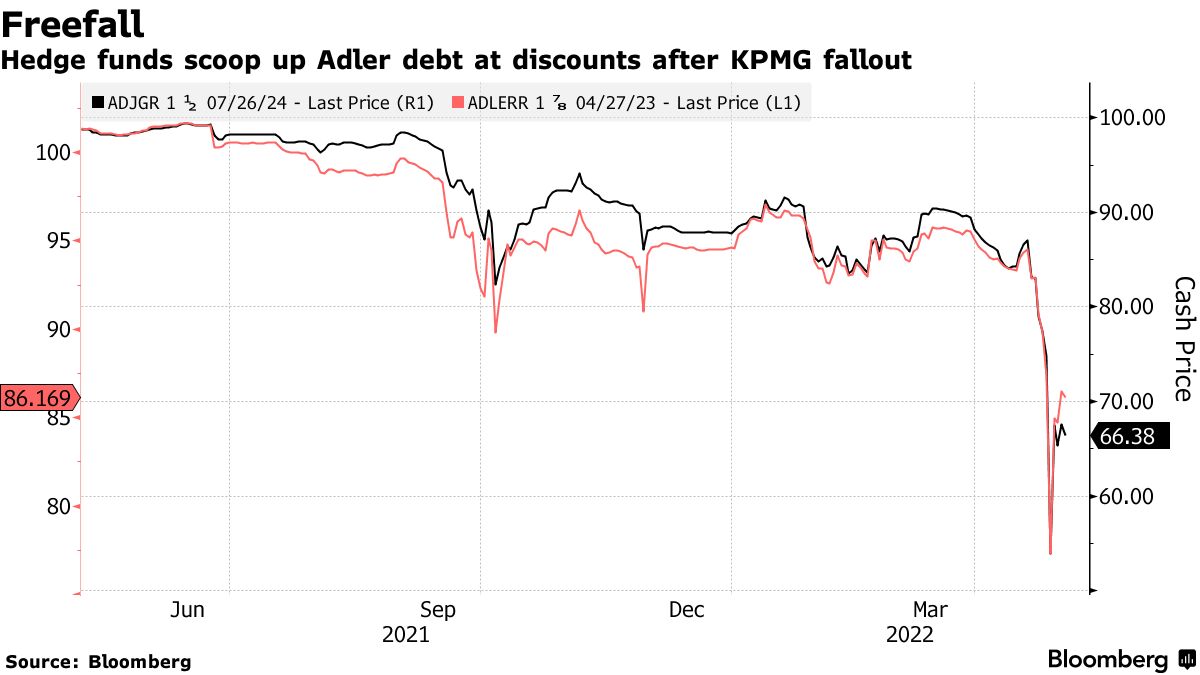

Adler debt is being picked up by hedge funds at discounted prices. Some of the buyers of Adler Group and Adler Real Estate bonds in recent weeks include CarVal Investors, Farallon Capital Partners, GLG Partners, Goldentree Asset Management, King Street Capital Management and Taconic Capital Advisors.

Representatives for King Street and GLG wouldn't comment on bond purchases. CarVal, Farallon and Goldentree didn't respond to messages seeking comment.

Adler Real Estate's bonds are indicated at 85 cents on the euro and credit-default swaps show that there is a 77% chance of default within five years. The Adler Group's bonds are trading between 55 cents and 70 cents.

With assistance from Lucca De Paoli.

(Updates with share price reaction in fourth paragraph.)