A new funding round for Alan has been raised. The company sells its own health insurance products. Alan wants to build a healthcare super app and a one-stop shop for all your questions and needs when it comes to your health.

Jean-Charles Samuelian-Werve told me that they decided to raise again at the beginning of the year. We didn't know how long the markets would last, but we knew they could turn around. We will be self-sufficient until we reach profitability.

The venture fund of the Ontario Teachers Pension Plan Board is leading the round. Existing investors in this new round include Exor, Dragoneer, and Lakestar.

Just a year ago, the startup raised its Series D and today's round is a Series E round. The company's post-money valuation has jumped quite a bit, despite Alan raising the same amount of money twice. The startup was valued at over a billion dollars last year. It has reached a valuation of over $2 billion at the current exchange rate.

We sell insurance products at cost — more or less. And then we add our membership fee on top. This model works really well Jean-Charles Samuelian-Werve

Alan's core business and biggest revenue source have not changed. The company was built in the 21st century. Alan built its own engine after getting approval from regulators.

The company now has the ability to sign up clients from all industries. Big companies can make changes to their insurance package.

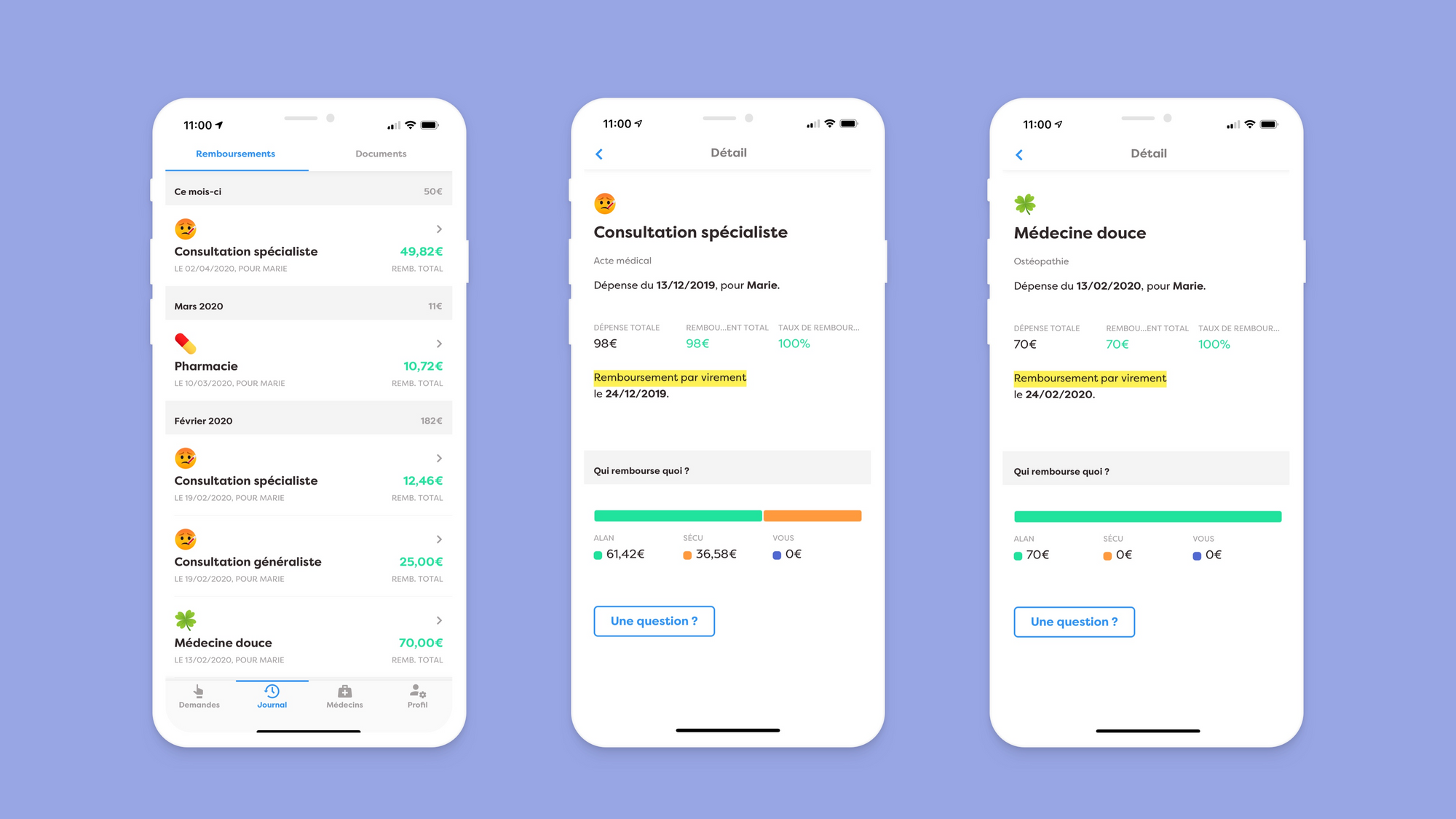

The experience with other insurance companies is not as good as it is with Alan's health insurance. Alan tries to automate as many processes as possible so that the user experience is seamless.

If you pay a bill at the doctor's office, Alan will transfer money to your bank account via an instant transfer. You are often reimbursed before you return to your home. France's national healthcare system will reimburse its part automatically, but it usually takes a few days.

Our model is 100% based on the loss ratio formula. We sell insurance products at a cost. The membership fee is added on top. Samuelian-Werve said that the model works well.

300,000 members have joined the company so far across 15,000 companies. Alan says it has an annual revenue of 200 million.

Alan is the image credit.

From the beginning, Alan's founders have been clear about their vision. They want to build an insurance company. They want to build a healthcare startup.

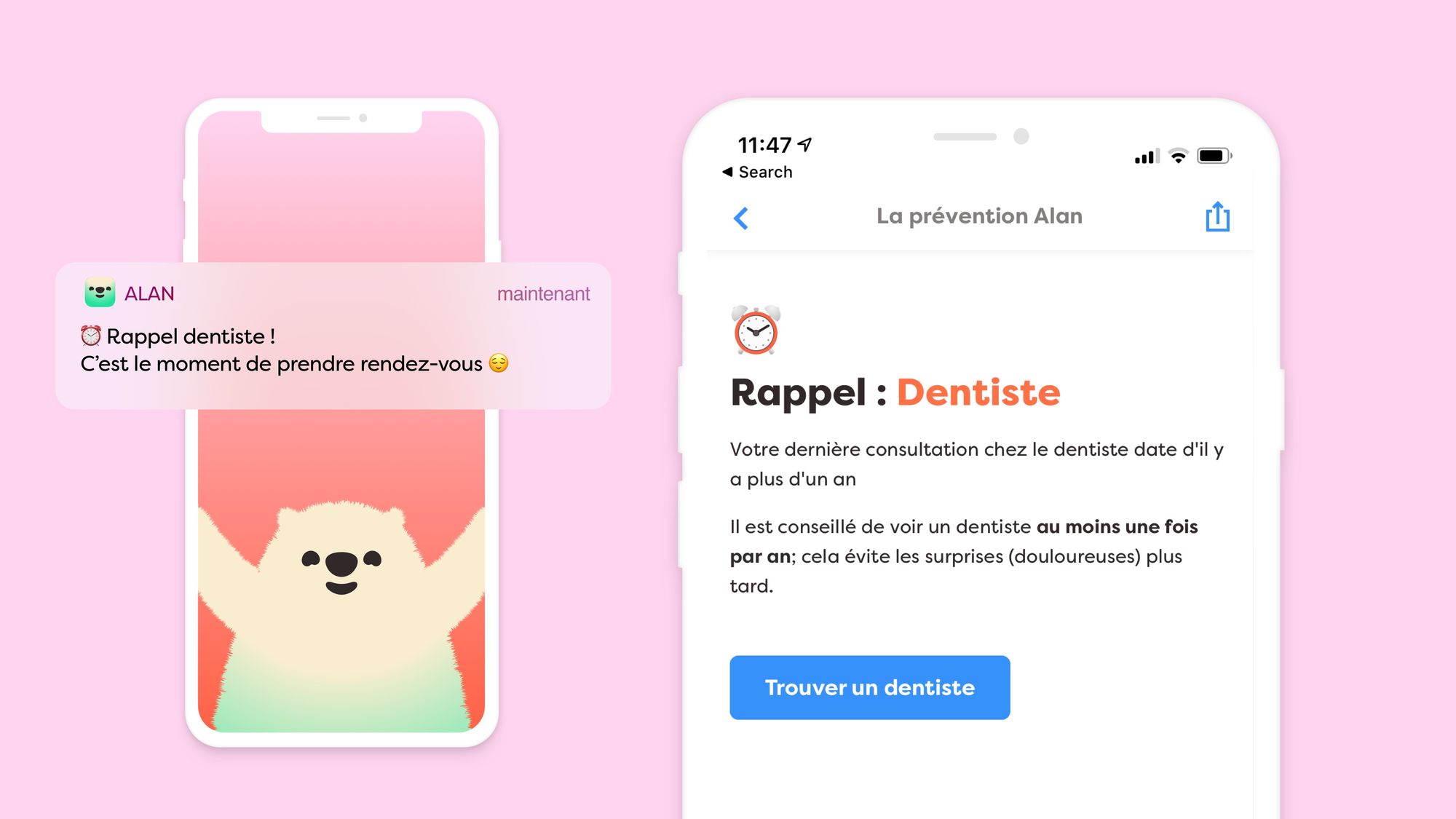

Users discovered that they could use the Alan app to find a health professional near them. The company is working with general practitioners so that they can answer your questions from a chat interface.

Some of the side bets have not worked. Alan launched Alan Baby a year and a half ago. There was a mix of content, community discussions and the ability to start a discussion with a doctor. Alan Baby is going to be shut down by the company.

Mental health is going to be a high priority in the years to come. Samuelian-Werve told me that Alan Baby was shut down so that we could reallocate resources.

Following the acquisition of Jour, Alan offers a consumer app. There is a B2B service called Alan Mind.

The company gives exercises. Whenever employees need to talk to an expert, they can do so. Some companies only subscribe to Alan Mind. They add the Alan Mind package to their contract.

Alan acquires Jour and launches mental health service Alan Mind

Alan now offers a way to try on glasses using augmented reality. You can buy a pair directly through the app if you like them.

Alan wants to make money by the end of the century. The startup will need 3 million members and will hire 1,000 by then. France, Belgium and Spain are where the company operates. There won't be a new market in 2022, but Alan could launch a new country.

Alan has a small market share. Samuelian-Werve said that we have less than 1% in the market.

We are at the beginning of our story. It's a first step, but everything is still ahead of us, he said.

Alan is the image credit.