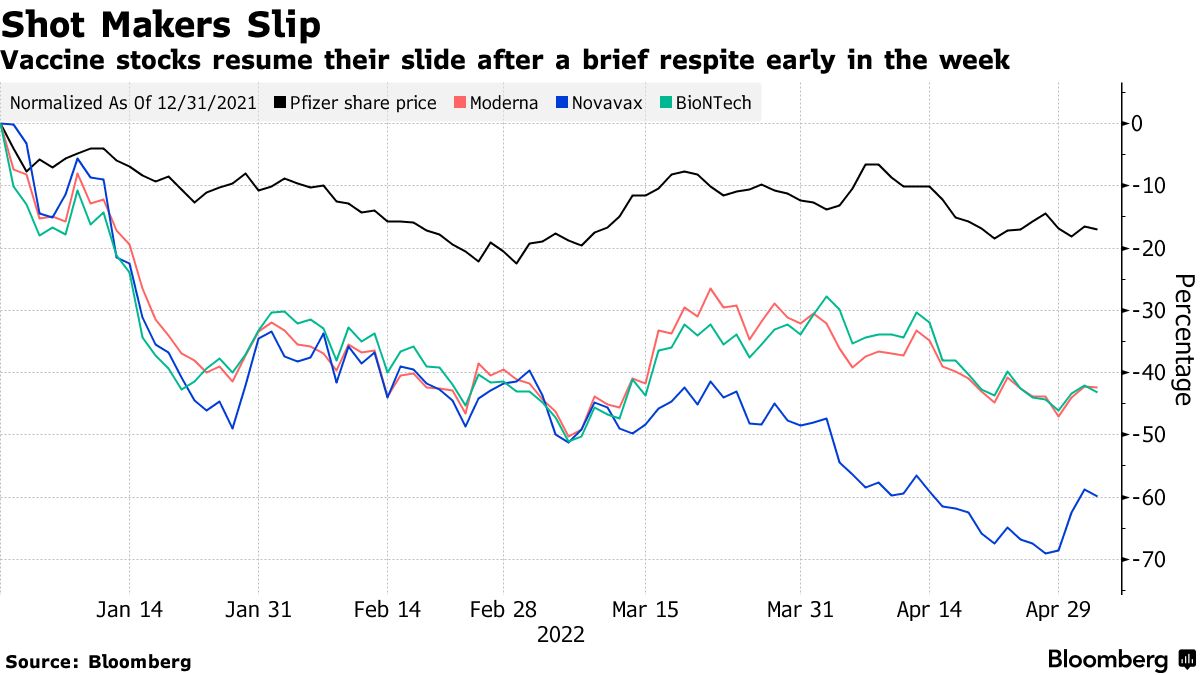

Pfizer and Moderna left the annual outlook unchanged despite first-quarter sales that beat estimates, which caused shares of shot makers to sink again.

Smaller peers and former retail favorites fell on Wednesday. Inovio Pharmaceuticals fell more than 5%.

Pfizer and BioNTech fell as much as 2.8% and 4.1%, respectively. Novavax Inc., whose Covid shot could face a Food and Drug Administration advisory panel in June, slipped more than 4%. The Cambridge, Massachusetts-based company warned during its earnings call that there was a potential downside to its vaccine orders in 2022.

Pfizer's first-quarter report that was released amid rising hospitalizations in New York State and recent lockdowns in China helped the group of vaccine makers trade higher on Tuesday. They resumed their descent on Wednesday.

Pfizer's diversified portfolio and large-cap drugmaker status has shielded it from a steep drop in its stock price. The group has suffered as a result of the larger macro rotation away from risky growth stocks. As the market tries to estimate the scope for existing and future Covid vaccines sales, they have taken a hit.

Moderna's first-quarter revenue of $6.1 billion beat estimates by nearly 30%, but leaving its full-year guidance intact suggests that a major reduction in 2Q consensus is needed.

The firm's stock doesn't look cheap since it's still trading at a $40 billion enterprise value, said a strategist.

The thesis hinges on the willingness of the public to take a fourth booster of the vaccine in the face of a potential Fall wave.