U.S. fuelmakers have an advantage over their European competitors due to a shortage of natural gas.

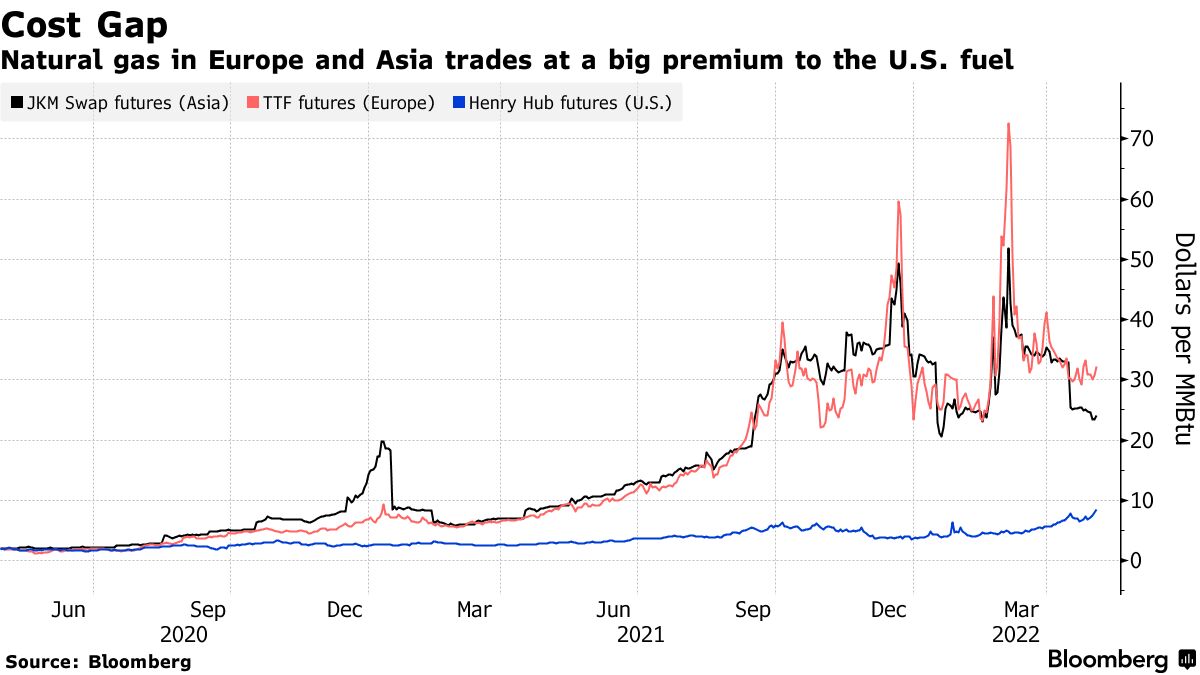

Natural gas is a crucial source of heat to distill crude oil into products such as diesel and gasoline. Gas prices in the US have more than doubled in the past year to top $8 per million British thermal units. The $32 European users have to pay pales in comparison.

Because the world is short of fuel, global prices for gasoline and diesel need to be set at levels that allow European refiners to keep running even as they outspend. The higher the gap is between natural gas prices in Europe and the U.S., the more profits American refiners such as Valero Energy Corp. will reap.

Valero Chief Executive Officer Joe Gorder said in a conference call that there should be a structural margin advantage for U.S. refining assets located in the Gulf Coast.

The U.S. is more profitable as the spread widens.

The price of diesel and gasoline is going to lead to a windfall for the refinery. The gain on making gasoline and diesel has more than doubled over the past year. Marathon and Valero, the two largest independent crude refiners in the U.S., are poised to collect record earnings in 2022, according to analyst estimates.

David Lamp, the CEO of CVR Energy Inc., said during a conference call with analysts that they were in an area that he hadn't seen before.

The cost of oil in the US has been reduced by as much as $9 per barrel due to cheaper natural gas.

Natural gas is a negative for the refining industry as it erodes profits. If domestic prices become more tied to the overseas market as exports grow, or if European supply disruptions ease, the U.S. advantage may disappear. Maryann T. Mannen, Marathon's CFO, said in a conference call with analysts that a one dollar move in heating fuel prices has an impact of $330 million on earnings before taxes and other items.

Mannen said that they would expect natural gas to be a problem as the year progresses.