Image source, Getty Images

Image source, Getty ImagesOn May 5th, the world's major oil exporters will meet to discuss how to bring down prices.

Opec+, which includes Russia, is not rushing to help.

Opec+ is a group of 23 oil-exporting countries that meet every month in Vienna to decide how much crude oil to put onto the world market.

Middle Eastern and African countries make up the majority of the 13 members of Opec. The aim of the group was to fix the worldwide supply of oil and its price.

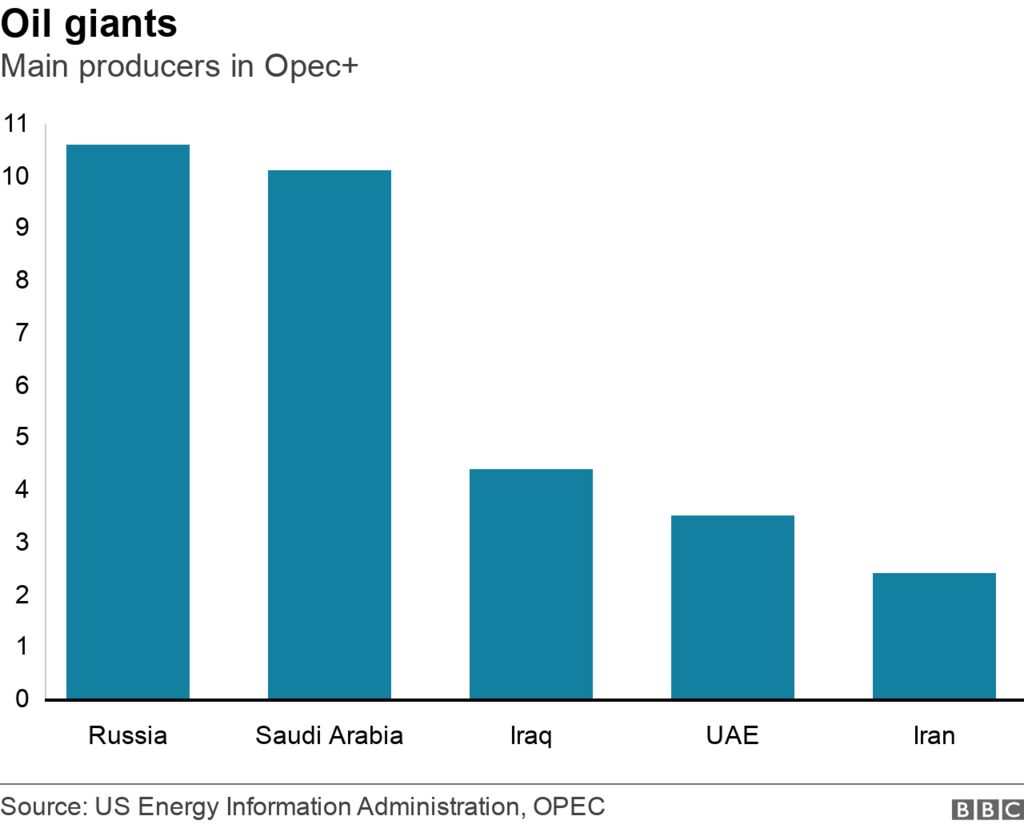

Opec nations produce about 30% of the world's crude oil. Saudi Arabia produces more than 10 million barrels of oil a day.

Opec and 10 non-Opec oil producers created Opec+ in 2016 when oil prices were low.

Russia produces over 10 million barrels a day.

Together, these nations produce 40% of the world's crude oil.

Kate Dourian of the Energy Institute says that Opec+ keeps prices high by tailoring supply and demand.

Major importers like the US and UK want Opec+ to put more oil onto the market in order to lower prices.

Image source, AFP

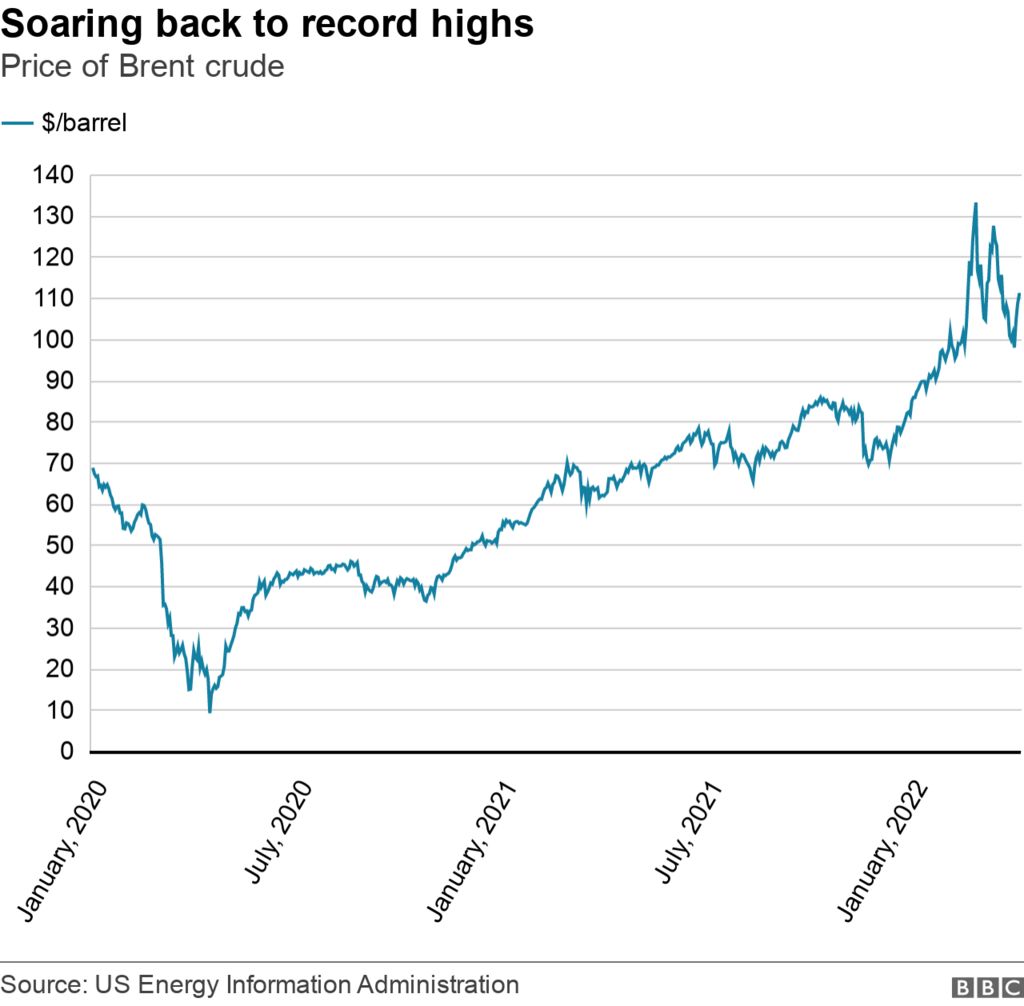

Image source, AFPThe price of crude oil crashed in the spring of 2020 because of a lack of buyers.

Ms Dourian says that producers were paying people to take the oil off their hands because they didn't have enough space to store it all.

Opec+ members agreed to cut production by 10m barrels a day to drive the price up.

With demand for crude beginning to recover, Opec+ started increasing supply in June of 2021. In the spring of 2020, it supplied two and a half million barrels of oil a day.

The price of crude soared when Russia invaded Ukraine. The price of petrol has gone up.

When Opec+ cut supplies by 10 million barrels a day in May 2020, they cut too deep, says David Fyfe, chief economist at Argus Media.

They are increasing supply at a slow rate that does not take into account the effects of the Russia-Ukraine crisis.

There is a fear among oil buyers that the EU will impose an embargo on oil imports from Russia. Europe imports over two and a half million barrels of crude a day from Russia.

The markets have been spooked by the threat of an embargo on Russian oil.

US President Joe Biden has been trying to get Saudi Arabia to increase its oil output.

Saudi Arabia and the United Arab Emirates were asked by the UK Prime Minister to increase production. He was also turned down.

Image source, Gertty Images

Image source, Gertty ImagesKate Dourian says that Saudi and the United Arab Emirates have spare capacity, but are unwilling to increase output on their own.

They say that the gap between supply and demand is narrowing, and that the high prices reflect panic on the part of oil buyers.

Opec nations are finding it hard to increase their oil production.

Over the past year, producers like Nigeria and Angola have been undershooting their production quota by a collective one million barrels a day.

Investment fell off during the Pandemic and some oil installations have not been well maintained. They are discovering that they cannot deliver production increases in full.

Image source, Getty Images

Image source, Getty ImagesOpec+ is one of the two biggest partners in the alliance, so it has to respect Russia.

The Russians are happy with prices at this level, according to the CEO of Crystol Energy.

Opec wants to keep good relations with Russia, so they are most likely to continue with the agreement they all made last year. Increasing crude supplies will be gradual from now until September.