Chris Baraniuk is a technology of business reporter.

Image source, Sean Gallup

Image source, Sean GallupMillions of people will buy electric vehicles in the next few years. Cars and trucks will run on batteries with metals.

The EV boom could be hampered by shortages of metals.

Megan O'Connor, chief executive and co-founder of battery materials mining and recycling firm, Nth Cycle, says that we don't have enough of these critical materials at the moment.

Her company has designed a way to extract nickel and other metals from old batteries.

It works by using an electrical current to separate metals from crushed up battery waste. The separated metals are trapped.

Nth Cycle's technology extracts nickel from clumps of rock and metals dug out of mines.

It may be a more sustainable method of recovering nickel than traditional techniques such as pyrometallurgy.

Image source, Nth Cycle

Image source, Nth CycleShe says that it's like a big furnace, and that you can imagine the carbon footprint.

Industry will need all the supplies of nickel it can get in the future, as it is an essential part of many of the products we use daily.

Many devices, including your phone, rely on a mix of nickel, manganese and cobalt for their power.

nickel is the largest component in some batteries.

Russia is one of the world's biggest nickel suppliers and the war in Ukraine has caused supply chain headaches, which is a problem for nickel.

As buyers look for non-Russian sources of the metal, countries such as Indonesia and the Philippines will likely boost their nickel output. There are questions over how sustainable this production will be.

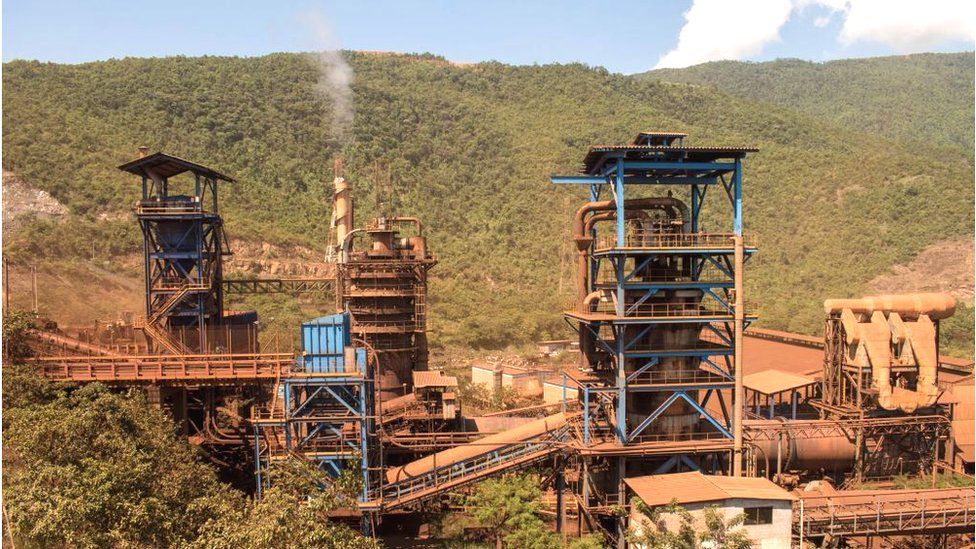

Image source, Getty Images

Image source, Getty ImagesNew mines will not be able to open quickly enough to satisfy rising demand for nickel, which is also used to make wind turbine components. She suggests that recycling old batteries will fix the supply problem.

Redwood Materials in the US is already acquiring batteries from the equivalent of between 60-80,000 electric vehicles every year.

The vice president for communications and government relations says that the majority of the elements from batteries are recovered.

The nickel market experienced a difficult episode in March, when the price of nickel on the London Metal Exchange spiked by 250% before falling again. It was more or less an unprecedented move to suspend trading of nickel for about a week.

The head of trading at a metals recycling firm says that the price of nickel remains volatile. The price is still higher than it was at the beginning of the year, despite the fall.

The price shock happened partly because a Chinese firm, Tsingshan Holding Group, had built up a large short position in the market, arranging contracts that bet the price of nickel would fall. The firm had to buy back the contracts or commit to supplying the nickel. Taking either option would result in a huge loss.

The company didn't reply to the request for comment.

Image source, Getty Images

Image source, Getty ImagesDisruption and panic on the market has caused traders to lose confidence, says Mr Wildie.

The Bank of England and the Financial Conduct Authority have announced reviews of the incident.

The LME is committed to ensuring that the actions of all participants are fully reviewed, and appropriate actions taken to both restore confidence and support the long-term health and efficiency of the market.

There were concerns about the future of nickel.

The new nickel mine on the Pacific island of New Caledonia was being worked on by a technical partner of the EV maker, and they had already moved to secure access to the metal.

Some firms can't take this option. More than two-thirds of the world's nickel production goes to the steel industry, where it ends up in everything from utensils to bathroom taps and washing machines.

nickel pricing and supply concerns have caused some factories in Europe to cut production.

MetalMiner founder and executive editor Lisa Reisman predicts that short term demand for the metal in some industries could fall.

She explains that high interest rates might cause a slowdown in the housing market, which would likely mean fewer people buying new appliances.

Electric cars will need a steady supply of nickel.

Light duty EV sales would reach 26.8 million by the year 2030. EV sales more than doubled between 2020 and 2021.

Image source, Getty Images

Image source, Getty ImagesThe elevated price of nickel probably won't have a big impact on EV sales, says S&P Global Platts senior analyst. He says that EV batteries are becoming an important driver of the nickel market.

Is it possible to recycle old batteries to fill the gap? It requires access to enough old batteries to make it worthwhile to get small amounts of nickel inside them.

The issue with that is that there needs to be the existing stock recycled. He says that this approach makes sense in the long run.

We need to start mining more of these materials and mining them more sustainable in order to meet our nickel needs in the future.