The first quarter financial performance of the American ride-sharing company showed continued improvement from the loss of business it experienced during the COVID-19 epidemic.

In the first quarter of the year, the former startup generated revenues of almost a billion dollars. The company's CEO said in a release that the company's larger than anticipated revenue haul was driven by increased demand and resilient driver levels.

The company's revenues were expected to be $846.0 million. In after-hours trading, the shares of the company fell by more than 12%. The company's results were soured by declining rider figures and the specter of driver incentives.

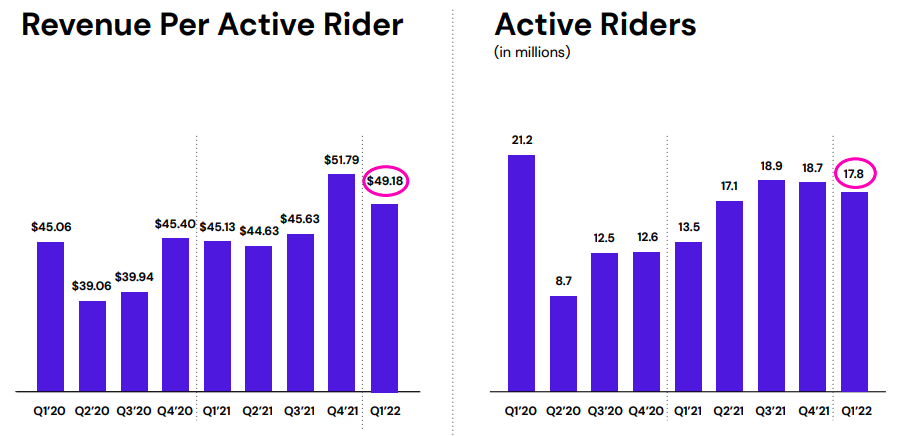

The business has improved off of deep COVID lows. In the first quarter of this year, the active rider count at Lyft was 17.8 million, up 32% from a year ago. The revenue per active rider increased to $48.18 in the first quarter of the year, compared to $45.13 in the year-ago period.

The rising revenue figure translated into profits.

The company had a very unprofitable quarter, posting a net loss of $196.9 million. The company's Q1 2022 net loss is a material percentage of its revenues.

The news is better in adjusted terms. The company's adjusted earnings before interest, taxes, depreciation and amortization for the first quarter of fiscal year 2020 was $54.8 million, up more than $127 million from a year ago. The era of ride-hailing companies with positive adjusted EBITDA continues.

So far, the company seems to be doing well, but why are its shares down? There are hints in the chart from its earnings presentation.

The image is from Lyft.

The company has seen a decline in per-rider revenue and a decline in active riders in the last two quarters, as well as a strong gain in active riders in the year-ago period. The metrics for future growth from the company are not encouraging for investors.

Adding to the bad news, the contribution result for Q1 was 888-282-0465 888-282-0465, which was smaller than what it recorded in Q3 It is clear that the work that has been done to climb out of its previous COVID has been done, but the near-term growth path is less clear than investors might have wanted.

Tomorrow, the domestic archrival of Lyft will report its own Q1 results. We will get a better look at the American ride-sharing market in those numbers, as well as an early look at the financial health of the delivery market, something that has long been missing from the company.