Homeowners used to only be able to take out a home equity loan if they wanted to. A new type of startup has emerged in recent years to give homeowners more options to cash in on their homes in exchange for a share of the future value of their homes.

Point, a Palo Alto-based startup, has raised $115 million in Series C funding after a year of rapid growth. The company did not reveal its valuation.

The startup was founded by a trio that included Alex Rampell, who is now a general partner at the company. Point was started by him, Eddie and Eddie's brother, Eoin Matthews, before he joined a16z. Rampell is not involved in the day-to-day operations of the company.

What does Point do? The startup is a marketplace that teams up homeowners with institutional investors, according to the CEO. Home Equity Investment is a product that allows homeowners to get cash in exchange for a certain percentage of future appreciation of their home. Point received over $1 billion in new capital commitments from real estate and mortgage-backed securities last year.

Point first evaluates the finances of applicants and then makes a offer. Point values the home and updates the final offer. Point says it will fund the investment within four business days once all closing conditions are met. Point makes 15-20% of the home's property value with the Home Equity Investment.

The average investment is $100,000. The average value of homes on its marketplace is around $700,000. 15-20% of a home's value is typically invested by investors. If a home is worth $1 million, they will put in $150,000 or $200,000.

Homeowners use the cash to do a variety of things, such as conducting home renovations, starting a small business, funding a child's education or saving for retirement.

There are homes valued at $250,000 on our marketplace, as well as multimillion-dollar homes, and everything in between.

The homeowner doesn't have to pay us back for 30 years.

The process is similar to a venture capitalist backing a startup.

An investor makes a VC investment into the home.

Point has invested in more than 5,000 homes. Over the past year, Point has seen a lot of growth, according to Lim. Point's funding volume was up over 5x in the first quarter of 2022, compared to the first quarter of 2021.

The US housing market is in a "watershed moment", where home equity has never been.

According to a recent report, Americans are sitting on $26 trillion of home equity.

The advantage to a homeowner of using Point is that they have no monthly payments, no income requirements and no need for perfect credit, according to the company.

Point is an asset-light fintech for home equity.

He explains that they don't own any assets and instead connect homeowners to investors. We charge asset management fees with the investor.

The company operates in 16 states, including California, New York, Florida, Massachusetts, New Jersey, Washington, Colorado, Pennsylvania, Illinois, Maryland, Michigan, North Carolina, Arizona, Minnesota, Oregon and Virginia.

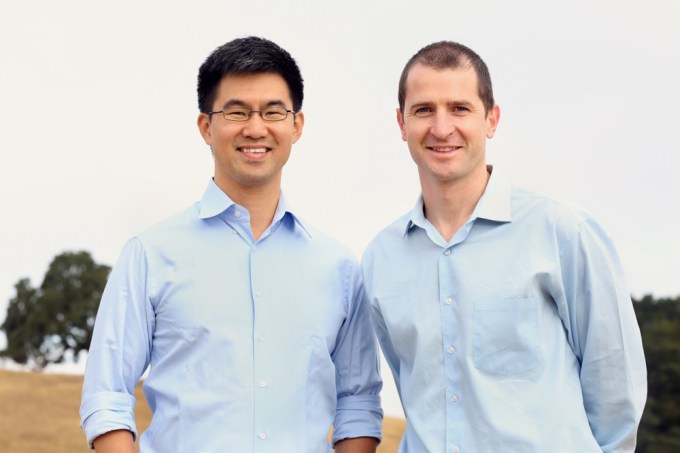

The co-founders are Eddie and Eoin Matthews.

The rise in mortgage interest rates has had a negative impact on the startup in the digital mortgage space. In this case, that may actually be serving as a tailwind for Point and companies like it, although the company is not out to replace refinancings.

He said people can still use Point.

HomePace raised $7 million last week in a Series A led by the corporate venture arm of a home builder. HomeTap raised $60 million in December. Point announced a securitization last October. Unison completed a $443 million securitization in February.

WestCap led Point's Series C, which also included participation from existing backers. Deer Park Road is one of the new investors.

The startup has raised more than $170 million in equity capital.

Point plans to use its new funds to scale its offering so it can support more growth, as well as to launch new products and expand its national presence. The company wants to hire more people. The startup has over 200 employees.

In many ways, we are just getting started, in terms of how many homeowners are out there and how much equity is out there. We want to bring this to every homeowner in the United States.

The founder and managing partner of WestCap was an angel investor before leading this round. He was the first to back the company.

WestCap is leading this round because they have developed the best and most consumer friendly solution for consumers with the least financial burden.

Tosi believes that Point's offering is the best-in-class and that it works with regulators.

The strength and depth of the team that Eddie has is what Rampell said in his statement.

On May 1st, I launched my weekly newsletter, The Interchange. You can get it in your inbox if you sign up here.

Point raises $8.4 million to buy a stake in your home