A financial model is one of the most important tools for a founder of a tech startup, even though financial projections are essential for any business.

Venture-backed startup work on risky, aggressive capital deployment, often operating at a loss for years as they pursue expansion and market dominance. This means that runway is a key financial decision point that needs to be kept an eye on.

Aggressive spending should translate into aggressive growth, as revenue could jump 20% or 30% month-over-month. Being able to expand the team a month earlier can make a huge difference in the long run, or cutting down expenses quickly can save the company from running out of money.

When milestones and deadlines are directly driven by your finances, you put yourself in a great position to iterate.

Most of the time, the tools to help make those decisions are built by the founder. The most common mistakes we see are connected with hundreds of founders every month.

In the fast-paced world of startups, quick and educated decisions are critical. Take a look at the example scenario.

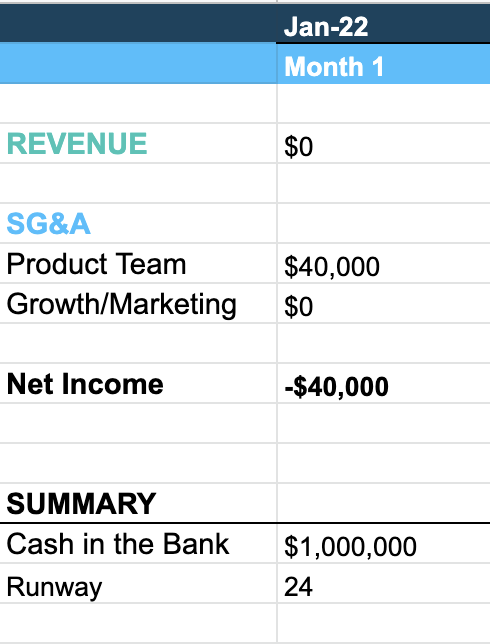

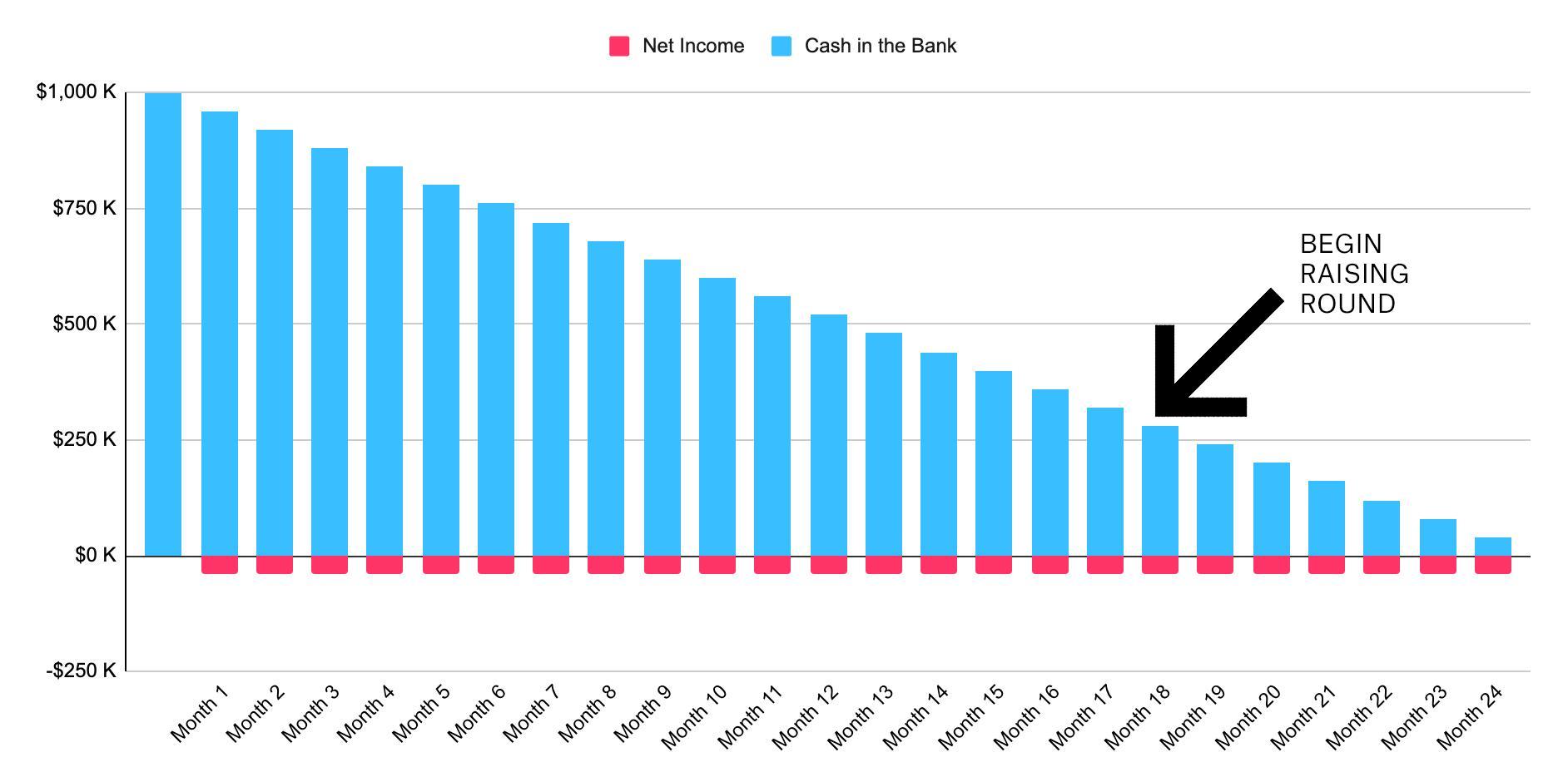

A company is looking to raise a $1 million seed round to finish building and launching its product.

Jose Cayasso is the image's author.

The company should be in a position to begin pitching to the next round of investors by month 18 if the new investor negotiations take about six months.

Jose Cayasso is the image's author.

Where should the company be when it wants to raise money? What amount of product should be ready? How much revenue will it bring in? How many people do you have? How much will it cost to get those customers?

The capital deployment needs to take all of those variables into account. Spending too much or not being able to close the next round before money runs out can be a result of a miscalculation. The stakes are high.

The problem is that seed-stage founders don't think about these targets when they define how much money they want to raise or how they want to spend it.

Entrepreneurs think of the financial model as homework, so they prepare it to satisfy an investor request or fill a slide in the pitch deck.

It is impossible for the model to predict revenue accurately at the pre-seed stage. The model should serve two main purposes for an early-stage company.