The startup has raised $200 million in a new financing round to expand its delivery service to more cities in India and grow its network of dark stores.

The Series D round was led by Y Combinator Continuity and valued the Mumbai-headquartered startup at about $900 million, up from $570 million in its December Series C round and $225 million in a round unveiled in October.

The startup said that Kaiser Permanente, the giant healthcare firm, as well as all key existing investors, participated in the new round.

The new round brings the startup's raise to $360 million.

Aadit Palicha and Kaivalya Vohra co-founded Zepto. The duo, who had previously worked on a number of projects, took Zepto out of stealth mode in November last year.

Palicha, who serves as Zepto's chief executive, said in an interview that the company processes hundreds of thousands of orders each day.

The startup's current revenue is between $200 million to $400 million, and he is determined to grow it to $1 billion by the quarter ending March next year.

He said that the startup has grown by over 50% each month in recent months. In the most recent quarter, the startup slashed its expenses by more than five times and grew its revenue by 800%.

Kaivalya Vohra and Aadit Palicha co-founded Zepto.

The quick commerce model, a category that has taken off in several markets including North America and Europe, is one of the earliest startup attempts in India. A number of startups operating in the space have either scaled down their efforts or shut down completely as venture investors lose appetite for fast delivery.

One startup that has committed to investing more than $700 million on its quick commerce service is called Instamart.

Grofers, formerly known as Blinkit, is trying to win a piece of the market. The SoftBank-backed startup recently agreed to an acquisition offer by Zomato, which in recent months has expressed interest in expanding to the quick commerce category, an area where it has historically performed poorly.

Zomato started a pilot of 10-minute delivery of food items in Gurugram. A range of prepared food items, including hot beverages and snacks, will be delivered within 10 minutes in select areas of Mumbai.

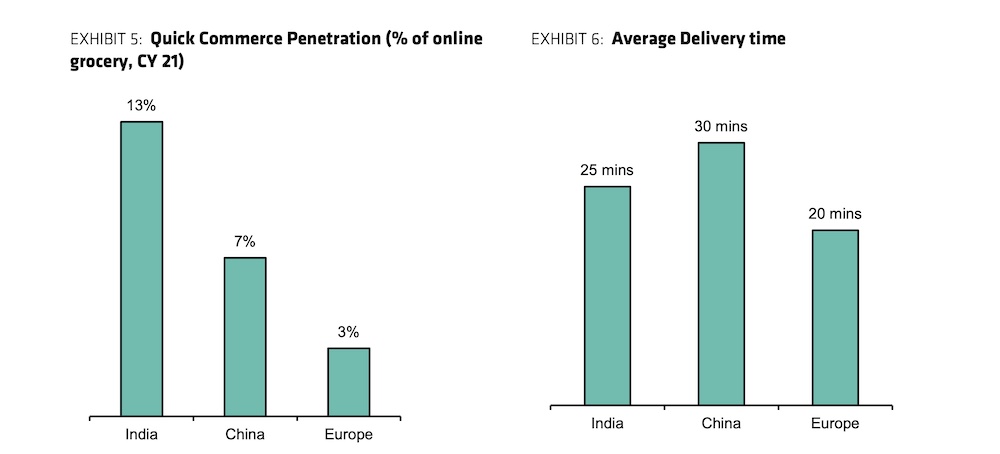

According to analysts at Sanford C. Bernstein, the market is at stake. India is leading other global markets in the adoption of quick commerce, according to analysts at the firm.

Increasing willingness and ability to pay premium for superior quality products and growing market for home delivery have contributed to the growth of quick commerce in the country.

There is a quick commerce market in India. Bernstein has data and image.

The average size of an order placed on an instant delivery service is $6 in India, compared to $12 to $15 for traditional online grocery orders. The models have seen an improvement in monthly order frequency with a healthy AOV of 400-500 Indian rupee. They said that quick commerce players are focused on driving a high Frequency basket which will drive better economics.

Palicha said that instant grocery delivery is just the beginning for Zepto. Though he declined to reveal the startup's audacious plans for the future, he said it's fair to assume that Zepto will expand to categories beyond grocery in the long-term, especially those that are currently underserved by giant e-commerce players.

The startup plans to open a few hundred more dark stores in the next 12 months and use them to store inventories. The startup has a catalog of items in different price ranges. The startup plans to double its workforce to 2,000 by the end of the year.