According to a new industry report, the EU should make big tech and video streaming companies pay at least some of the estimated 28 billion dollars they cost European telecoms groups for their outsized use of network infrastructure.

A small number of video, social media and tech companies, including Facebook owner Meta, account for more than 55 per cent of all traffic on mobile and broadband networks, according to research commissioned by the European Telecommunications Network Operators. European telecommunications companies spend between 15 billion and 28 billion on this each year.

The report claims that if some of these tech groups handed over 20 billion dollars to telecoms companies to cover and increase network investment, it could create 840,000 new jobs and reduce energy consumption in the sector.

Lise Fuhr, director-general of ETNO, said that they want to launch an open dialogue with policymakers, consumers and tech companies on how to address the specific imbalances in internet traffic markets.

Telecoms companies have been involved in a debate with regulators about whether Big Tech companies, which use up a significant portion of network data, should be made to pay for some of the costly upgrades to infrastructure being undertaken by mobile and broadband carriers.

A recent case in South Korea, where a court ordered the streaming service to pay for a surge in traffic over the SK broadband network, has been pointed to by executives.

The European Commission's declaration on digital rights that all market players benefiting from the digital transformation should make a fair and proportionate contribution to the costs of public concern them.

The most effective way for the commission to get a contribution from Big Tech companies would be for them to create a mechanism for direct payments towards infrastructure projects or to telecoms groups themselves, the report said.

It argued that imposing a tax or creating a separate fund for investment would be difficult to sell to the public.

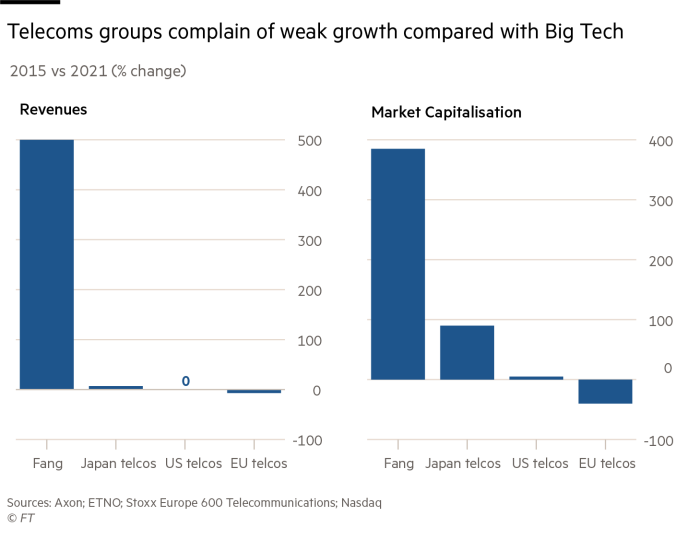

The report shows how European telecoms groups invested 500 billion dollars over the past decade to upgrade and improve their fixed and mobile networks, but are in a much weaker financial position than comparable companies in the tech sector. The top eight telecoms groups have a total market value of more than the top six tech groups.

Big tech and video streaming companies argue that their bundling agreements with telecoms companies help attract and retain customers, and that they contribute to the cost of network upgrades.

We partner with European internet service providers to make networks more efficient. We invested a lot in our own content delivery network.

They said that the more than 700 locations they have built in Europe had reduced traffic on broadband networks.

Amazon didn't comment. Meta didn't reply to the request for comment.

Tech groups were correct to point out that they already contributed to content delivery, according to Matthew Howett, an analyst at Assembly Research.

Although previous attempts at changing the rules in Europe have not been successful, Howett suggested that greater awareness of the environmental benefits of network upgrades, and of the importance of connectivity during the Covid-19 pandemic, may pave the way for a different outcome.