Benchmark indices snapped a six-day losing streak on October 9.

Sensex closed 645.97 points or 1.72 percent higher at 38,177.95 while the Nifty index closed 186.90 points or 1.68 percent higher at 11,313.30.

"The bulls staged a smart comeback led by short covering and stable global cues. The broader markets underperformed with BSE Midcap and Smallcap ending with gains of 1.4% and 0.7%," said Ajit Mishra, Vice President, Research, Religare Broking.

According to the pivot charts, the key support level for Nifty is placed at 11,161.8, followed by 11,010.3. If the index starts moving up, key resistance levels to watch out for are 11,393.2 and 11,473.1.

Nifty BankNifty Bank closed with a gain of 3.67 percent at 28,785.85. The important pivot level, which will act as crucial support for the index, is placed at 28,039.36, followed by 27,292.93. On the upside, key resistance levels are placed at 29,194.96 and 29,604.13.

Call options dataMaximum call open interest (OI) of 23.93 lakh contracts was seen at the 11,500 strike price. It will act as a crucial resistance level for the October series.

This is followed by 11,200 strike price, which holds 17.86 lakh contracts in open interest, and 11,600, which has accumulated 15.88 lakh contracts in open interest.

Call unwinding was witnessed at 11,200 strike price, which shed 14.08 lakh contracts.

Put options data

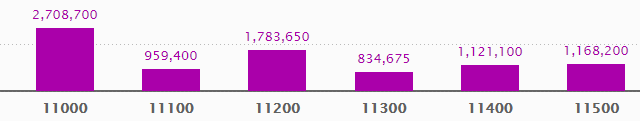

Put options data Maximum put open interest of 27.08 lakh contracts was seen at 11,000 strike price, which will act as crucial support in October series.

This is followed by 11,200 strike price, which holds 17.83 lakh contracts in open interest, and 11,500 strike price, which has accumulated 11.68 lakh contracts in open interest.

Put writing was seen at the 11,200 strike price, which added 2.15 lakh contracts, followed by 10,800 strike, which added 2.12 lakh contracts.

No major Put unwinding was seen.

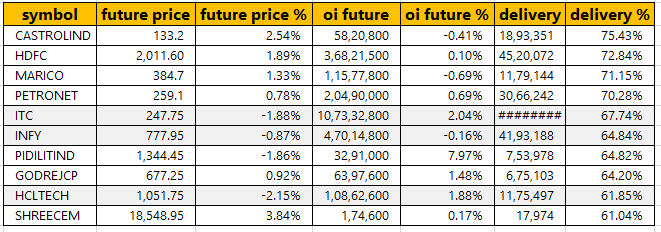

Stocks with a high delivery percentage

Stocks with a high delivery percentage A high delivery percentage suggests that investors are showing interest in these stocks.

67 stocks saw long buildup

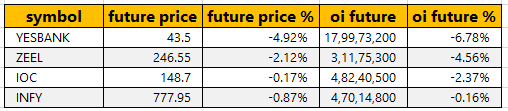

67 stocks saw long buildup  4 stocks saw long unwinding

4 stocks saw long unwinding Based on the lowest open interest (OI) future percentage point, here are the top 15 stocks in which long unwinding was seen.

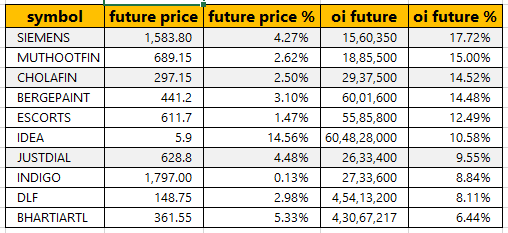

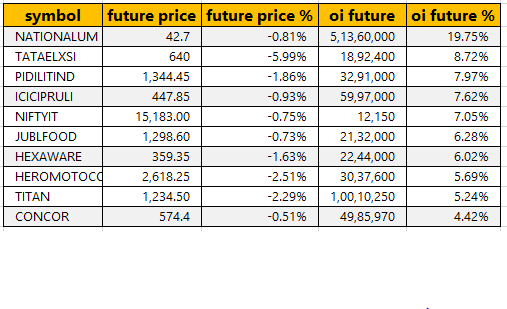

18 stocks saw short build-up

18 stocks saw short build-up An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 15 stocks in which short build-up was seen.

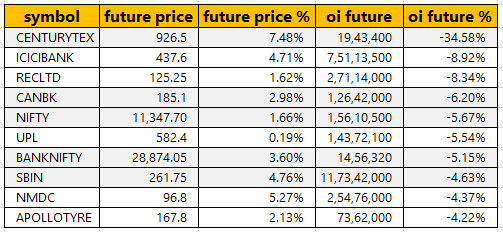

62 stocks witnessed short-covering

62 stocks witnessed short-covering As per available data, 27 stocks witnessed short-covering. A decrease in open interest, along with an increase in price, mostly indicates a short covering. Based on the lowest open interest (OI) future percentage point, here are the top 15 stocks in which short-covering was seen.

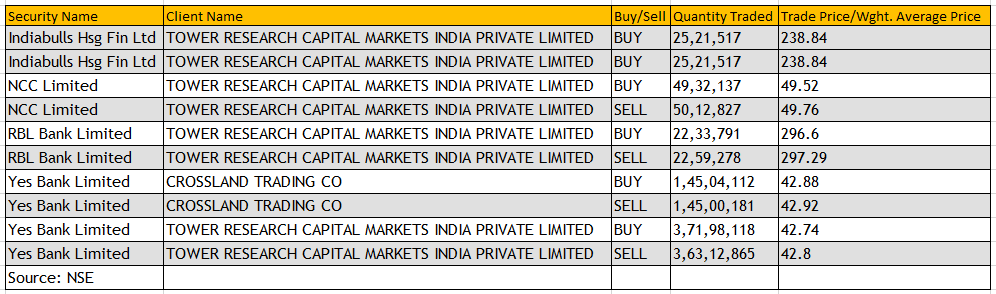

Bulk Deals

Bulk Deals  (For more bulk deals, click here) Upcoming analyst or board meetings/briefings

(For more bulk deals, click here) Upcoming analyst or board meetings/briefings PI Industries - board meeting on October 23 to consider and approve the financial results for the period ended September 30, 2019

Larsen and Toubro - board meeting on October 23 to consider and approve the financial results for the period ended September 30, 2019

Indiabulls Ventures - To consider buyback for equity shares on October 11

Mindtree - board meeting on October 16 to consider and approve the financial results for the period ended September 30, 2019 and to consider declaration of interim dividend, if any amongst other matters.

NMDC - board meeting on October 11 to consider the proposal for fund raising

Bharti Airtel: Company announced successful pricing of $750 million 5.650% subordinated perpetual securities, aimed to achieve objectives of deleveraging & strengthening of the balance sheet.

Bank Of Maharashtra: RBI denied request to set off accumulated losses of Rs 7,360 crore.

Transformers & Rectifiers: Company received a Rs 126 crore order from Power Grid.

Dixon Technologies: ICRA assigned A1+ rating to company's enhanced commercial paper (CP) programme.

Vimta Labs: Brickwork Ratings India reaffirmed credit rating of the company for the bank loan facilities of Rs 50.33 crore.

Rama Steel Tubes: CARE revised credit rating on company's long term bank facilities to BBB-/Stable from BBB/Negative.

FII & DII dataForeign institutional investors (FIIs) sold shares worth Rs 485.24 crore, while domestic institutional investors (DIIs) bought shares of worth Rs 956.24 crore in the Indian equity market on October 9, as per provisional data available on the NSE.

No stock under ban period on NSEThere is no stock under the F&O ban for October 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit. Get access to India's fastest growing financial subscriptions service Moneycontrol Pro for as little as Rs 599 for first year. Use the code "GETPRO". Moneycontrol Pro offers you all the information you need for wealth creation including actionable investment ideas, independent research and insights & analysis For more information, check out the Moneycontrol website or mobile app.