Rupee appreciated by nearly 4 percent during October 2018-December 2018. The turnaround in rupee was mainly on account of softening crude oil prices which led to domestic inflation cooling down during this phase.

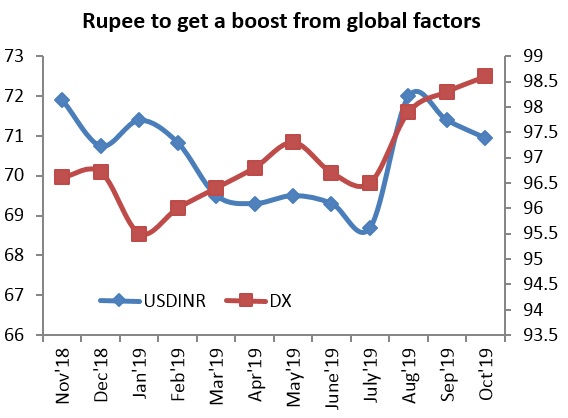

In this phase, Brent crude oil prices declined by nearly 35 percent, and CPI inflation touched a low of 2.11 percent in December 18. The trend reversed in 2019 with rupee depreciating by nearly 1.25 percent from January-October. Meanwhile, the dollar index continued to climb higher in 2019 and touched 98.15 in October.

On account of the CPI inflation remaining under RBI's target of +/-4 percent, the RBI decided to cut interest rates four times by 25 bps in 2019 and one more time by 35 bps. The current repo rate stands at 5.15 percent. Interest rates are likely to follow a bearish path in order to boost growth and private consumption within the economy and provide relief to the citizens.

Indian economy on a likely recourseAccording to the latest World Bank report, India's growth is expected to gradually recover to 6.9 percent in FY21 and 7.2 percent in FY22 on the back of income support schemes, investment responding to corporate tax cuts and with credit growth picking up.

On the trade talk's front, the United States and China reached a partial deal on October 11. In the meeting, the US decided to suspend next tariff hikes on China on 250 billion of Chinese imports. In return, China would purchase $40-50 billion worth of American farm products such as soybeans and Pork, among others.

Easy Monetary Policy - The Agenda?The US FED increased interest rates by four times in 2018. In the 2019 FOMC meeting, it was highly unlikely for the US FED to increase interest rates, similar to 2018. In its last meeting in September, Jerome Powell decided to cut interest rates by 25 bps amid slowdown in the economy. Some FED reserve policymakers expressed concerns at their most recent meeting that markets would be expecting more rate cuts than what the US FED might deliver, according to the meeting's minutes.

In 2018, inflation was constantly above the 2 percent target set by the US Fed, and they were constantly adding up new jobs in the economy (190,000 jobs added in 2018 as compared to 180,000 in 2017). However, in 2019, inflation has remained subdued and below the US FED's target of 2 percent. The US has added on an average of 156,000 jobs per month between January-October which is much lower than 2018's average.

Rupee likely to strengthen as risk appetite increasesTrade talks progressing smoothly, continuous inflows in the Indian equity markets and easing monetary policy by the US FED can possibly lead to appreciation of Indian rupee.

The inflow of capital by the FII's into the equity market stood at Rs 51,230 crore for the period of January to October. Similarly, there was an inflow of Rs. 27,924 crore in the Indian debt market during the same time period.

Also, the US FED will start purchasing T-bills worth $60 billion per month from October 15 on a monthly basis till the second quarter of 2020. This move was induced by the US FED in order to infuse liquidity in to the money markets.

The world would be eyeing the next leg of the Sino-US trade talks after a successful round of talks in Washington, and the US FED expected to cut interest rates in future are possible factors which would led to possible appreciation of Indian rupee in the near future.

Hence, the likely trend of rupee is to move lower towards the 69 mark by the end of November.

(The author is Research Associate - Currencies at Angel Broking Ltd)Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Are you happy with your current monthly income? Do you know you can double it without working extra hours or asking for a raise? Rahul Shah, one of the India's leading expert on wealth building, has created a strategy which makes it possible... in just a short few years. You can know his secrets in his FREE video series airing between 12th to 17th December. You can reserve your free seat here.