Qantas has posted an AU$2.7 billion ($1.93 billion) loss in the 2020 financial year, as the airline grapples with the unprecedented impacts of COVID-19. CEO Alan Joyce says the events have shaped up to create "the worst trading conditions" in Qantas' 100-year history.

As with most major airlines, Qantas is reducing their workforce. In total approximately 20% of their workforce will be axed, including 25% of their corporate staff. However, Alan Joyce has reinforced that downsizing is not the golden ticket to post-COVID success.

Moving forward Qantas will refocus their operations to create a sustainable trading environment, factoring in the future of travel:

"We've had to make some very tough decisions in the past few months to guarantee our future. At least 6,000 of our people will leave the business through no fault of their own." Alan Joyce, CEO, Qantas Group

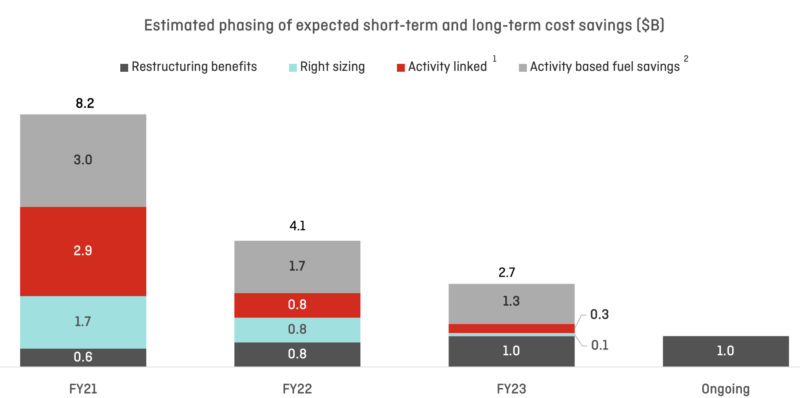

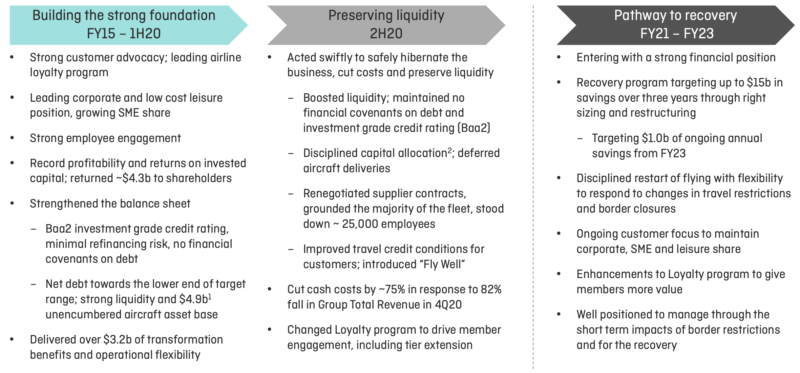

Under the recovery plan announced by Mr Joyce, approximately AU$15 billion ($10.7 billion) will be saved over three years. In order to achieve this, Qantas will cut costs associated with a large workforce (job cuts and lengthy stand-downs), look for cheaper fuel options and save on maintenance costs (through extended aircraft groundings).

From the Australian 2023 Financial Year (July 2022 - 30 June 2023), Qantas is looking to save around AU$1 billion ($716 million) annually.

Qantas has already implemented elements of their ambitious recovery plan, by implementing the following changes:

"Recovery will take time and it will be choppy. We've already had setbacks with borders opening and then closing again, Most airlines will come through this crisis a lot leaner, which means we have to reinvent how we run parts of our business to succeed in a changed market."Alan Joyce, CEO, Qantas Group

Despite posting a significant overall loss, Qantas made an AU$56 million ($40 million) profit for international travel; driven by a record performance by Qantas Freight with the rise of e-commerce. In total, the airline posted a profit loss of 91% year-on-year.

Qantas started the Financial Year strong, recording AU$771 million ($552 million) profit before tax between July and December. However, the second-half saw a record AU$4 billion ($2.87 billion) loss due to the COVID-19 crisis.

From April to the end of June, Qantas Group revenue fell 82% while cash costs were reduced by 75%. This helped Qantas weather the initial financial storm.

The record-breaking statutory loss can be broken into two equal categories: cash and non-cash, making up approximately 50% each. Put simply, the biggest loss factor is the aircraft themselves, accounting for AU$1.4 billion ($1 billion).

This large figure is indicative of a write-down of assets including Qantas' A380 fleet, which reflects that many of its aircraft "will be on the ground for years".

Mr Joyce said the FY2020 result showed how the COVID-19 crisis had derailed what would have been a strong financial performance.

"We were on track for another profit above $1 billion when this crisis struck. The fact that we still delivered a full-year underlying profit shows how quickly we adjusted when revenue collapsed." Alan Joyce, CEO, Qantas

Despite significant uncertainty across most markets, Qantas remains reasonably well positioned to take advantage of the eventual return of domestic and, ultimately, international travel demand.

In the meantime, Qantas Freight and Qantas Loyalty continue to generate significant cash flow. Throughout the COVID-19 crisis, Qantas has also continued to perform extremely well with mining charters in Western Australia.

Mr Joyce was quick to point out that Qantas' new market position, being the only Australian airline with long-haul international services. This follows the collapse of Virgin Australia, which will be abolishing long-haul international services under its "Virgin 2.0" plan.

"Our message is simply this: the Flying Kangaroo's wings are clipped for now, but it's still got plenty of ambition. And we plan to deliver on it. We are, and always will be, the Spirit of Australia."Alan Joyce, CEO, Qantas GroupHow do you think Qantas has performed? What is their future? Let us know in the comments.