Bears have tightened their grip on D-Street in the truncated trading week after the World Health Organisation (WHO) declared COVID-19 as a pandemic. This dampened investor sentiment and benchmark indices hit a lower circuit, a first since the 2008 crisis.

On March 10, the market was shut on account of Holi.

WHO declared COVID-19 as a pandemic after the virus spread across 124 countries. Globally, over 1.3 lakh people have been infected, with over 5,000 fatalities - majority of them in China. Infections have steadily risen in Iran, Italy, South Korea and the US. On March 13, US President Donald Trump declared coronavirus a US national emergency.

On the economic front, retail inflation for February stood at 6.58 percent versus 7.59 percent in January.

Swiss brokerage UBS too sharply cut its FY21 GDP growth forecast to 5.1 percent on fears around the coronavirus outbreak. The brokerage also cut its FY20 growth estimate marginally to 4.8 percent.

On March 13, the market opened gap down and hit a lower circuit in few minutes of trade. After that, trading was halted for 45 minutes. On resumption of trade, the market recouped most of the day's losses and posted its biggest intraday recovery to end on a positive note.

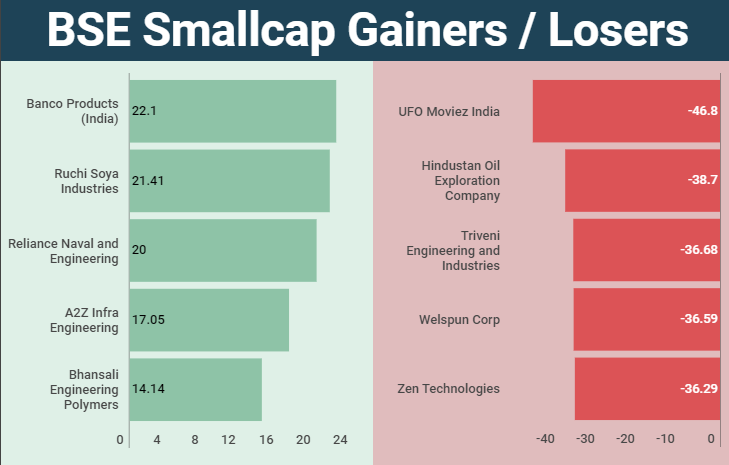

Benchmark indices posted their biggest weekly fall ever, with the Sensex and Nifty falling 3,473.14 points (9.24 percent) and 1,034.25 points (9.41 percent) to end at 34,103.48 and 9,955.2 levels. The BSE Smallcap, Midcap and Largecap indices have tumbled 11.77 percent, 11.17 percent and 9.48 percent, respectively.

This week, domestic institutional investors (DIIs) bought equities worth of Rs 17,596.40 crore, while foreign institutional investors (FIIs) sold equities worth Rs 19,613.81 crore.

FIIs have remained sellers from the last 14 sessions as they sold equities worth Rs 41,702.97 crore. On the other hand, DIIs bought equities worth Rs 43,675 crore.

In March so far, FIIs have sold equities worth Rs 30,334.30 crore, while DIIs bought equities worth Rs 27,689.18 crore.

The rupee ended 13 paise lower at 73.91 on March 13 against its March 6 closing of 73.78. However, it has touched a record low of 74.50 on March 13.

On the weekly technical chart, the Nifty has formed a hammer candlestick pattern, which is considered a bullish reversal pattern as it mainly occurs at the bottom of the trend.

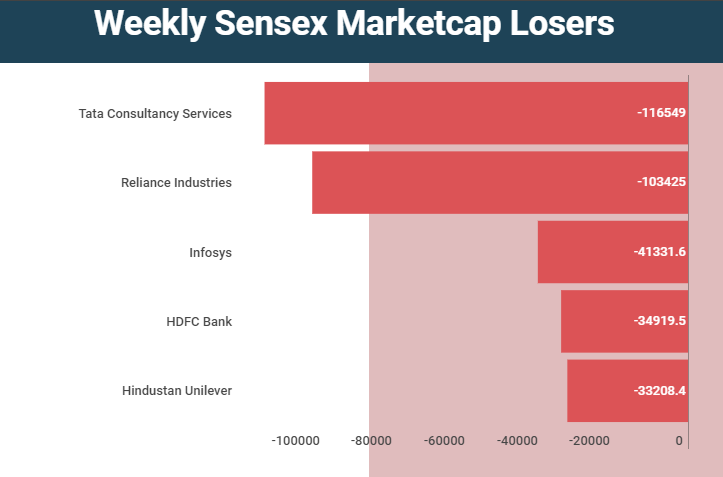

On the BSE, TCS lost the most in terms of market value, followed by Reliance Industries and Infosys this week.

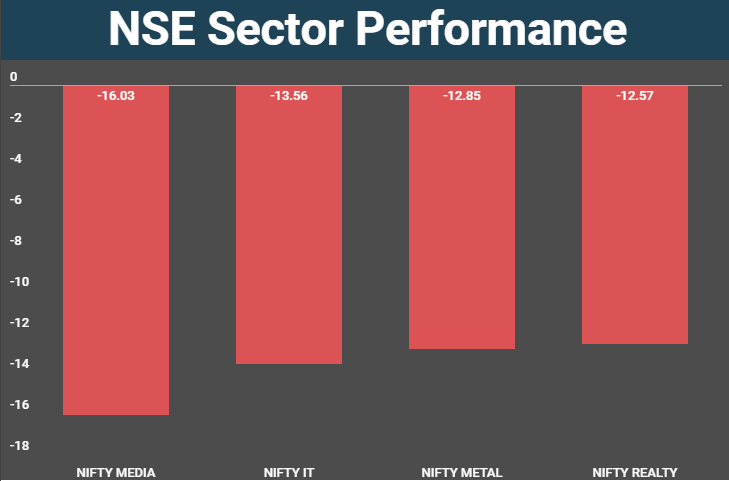

On the BSE, TCS lost the most in terms of market value, followed by Reliance Industries and Infosys this week.  The Nifty Media index underperformed sectoral indices with a loss of 16 percent during the week.

The Nifty Media index underperformed sectoral indices with a loss of 16 percent during the week.  Disclaimer: Reliance Industries is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments.

Disclaimer: Reliance Industries is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments. Time to show-off your poker skills and win Rs.25 lakhs with no investment. Register Now!