The truncated week for the Indian market turned into a nightmare for bulls as investors lost over Rs 15 lakh crore in terms of market capitalisation (m-cap) on the BSE in just four trading sessions.

Benchmark indices, after witnessing their worst fall in absolute terms, staged a smart recovered once the lower circuit filter was lifted on March 13. The Sensex reclaimed the 34,000 mark and the Nifty is back above 9,900.

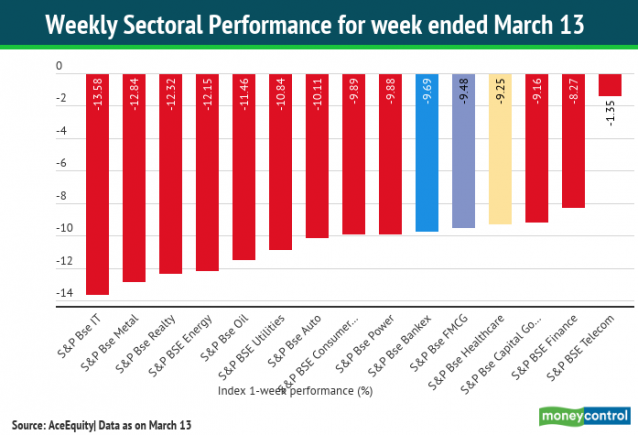

For the week-ended March 13, the Sensex and Nifty plunged 9.2 percent and 9.4 percent, respectively. The benchmark indices logged their worst week since July last year.

Investor wealth, as defined by m-cap, fell more than Rs 15 lakh crore on the BSE. The average m-cap of the BSE-listed companies fell to Rs 129.26 lakh crore as on March 13 from Rs 144.31 lakh crore on March 6, a fall of 10.43 percent.

Over 300 constituents of the BSE 500 index fell 10-40 percent. Of these, around 75 stocks plunged 20-40 percent. These include: NCC, Corporation Bank, Adani Power, Welspun Corp and Future Retail.

Note: Here is a list of top 50 constituents from the BSE 500 index that fell 20-40%

The market recovery was led by positive global cues after reports suggested that a stimulus package by the US Federal Reserve would help limit the economic damage caused by the coronavirus pandemic.

Earlier this week, panic selling was seen across global markets after the virus was officially declared a pandemic by the World Health Organisation. European nations, US, Iran and others too registered an increase in the number of infections.

Foreign investors have been net sellers to the tune of Rs 16,000 crore this week. In March so far, they have pulled out over Rs 30,000 crore from the cash segment, provisional data from SEBI showed.

Experts feel sentiment around the spread of the virus will continue to drive market sentiment in the near term and hence advise investors to tread with caution.

Ritesh Asher, Chief Strategy Officer (CSO) at KIFS Trade Capital, expects the Nifty to pullback to 10,000-10,500 levels. However, he does not rule out further selling pressure if the solution for the coronavirus pandemic is not discovered soon.

Technical outlook: The Nifty staged a smart bounceback on March 13 after hitting a panic low of 8,555. For the week, the index is down about 9.4 percent. Though it has witnessed a sharp rebound on March 13, it has corrected more than 30 percent in the last three months.

Soon after the market opened for trading after halting on touching its 10 percent lower circuit, bulls rushed in with vengeance tracking positive global cues. This lifted the index into positive territory and beyond its March 12 high.

"The recovery halted near the key hourly moving average. On the higher side, 10,200-10,300 acted as key resistance and can continue to do so going forward. The overall structure shows that the Nifty can consolidate further between 9,000 and 10,000 levels. Currently, the index is trading near the upper end and can dip towards the lower end, i.e. 9,000," Gaurav Ratnaparkhi, Senior Technical Analyst, Sharekhan told Moneycontrol.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Time to show-off your poker skills and win Rs.25 lakhs with no investment. Register Now!