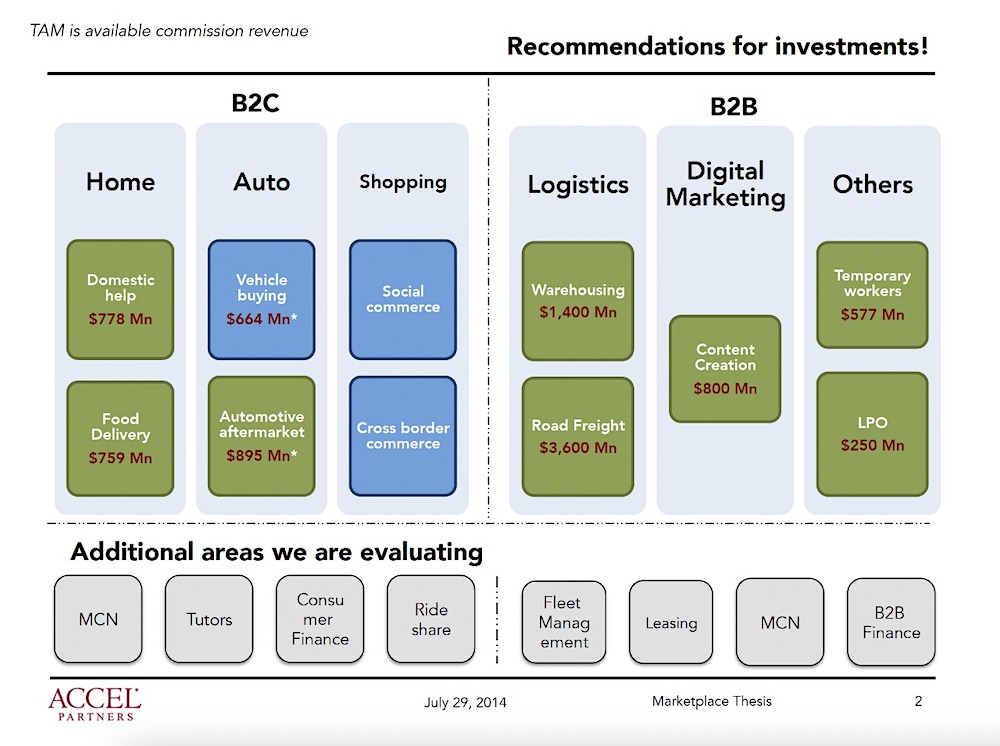

Prayank made a pitch to the firm about the future of India's marketplaces.

Only two e- commerce startups in India had shown a semblance of scale. As more Indians come online, opportunities will arise in food delivery, automotive aftermarket, warehousing, road freight, and social commerce.

He turned out to be correct. Urban Company, which operates in the domestic help sector, is valued at over $2 billion, while Zomato and Swiggy are delivering food to millions of customers each month, Spinny and Cars 24 are selling hundreds of thousands of cars each quarter, and DealShare is valued at over $2 billion

Over 100 million Indians make online transactions each month and hundreds of millions have come online in the past 10 years. In the past five years, India has attracted over $75 billion in investments from companies such as Amazon, Meta, Tiger Global, SoftBank, Alpha Wave and Lightspeed.

There is a presentation from 2014) The images are from the film, "Accel."

As the local startup community closes one of its toughest years, it is staring at another question that it has been able to ignore.

Half a dozen consumer tech Indian startups went public in the past year and a half, but all of them are performing poorly on the local stock exchanges. This year, Zomato, Policy Bazaar, and Delhivery have all gone down.

The Indian stocks have performed better than the S&P 500 and China's CSI 300. The Indian stock benchmark is up 3.4% this year, compared to a fall of 19.75% in the S&P 500 and a decline of 21% in the CSI 300.

Many Indian startups have delayed their listing plans due to the changing market. Two people familiar with the matter say that Oyo's plan to list in January is unlikely.

A person familiar with the matter says that Walmart-owned Flipkart won't list until at least 2024. Byju's, India's most valuable startup, doesn't plan to list in 2023 but is moving ahead with a plan to list one of its subsidiaries next year, according to a previous report.

After getting hammered in China and other emerging markets this year, several global public funds that ardently finance the pre-IPO rounds are retreating from the Indian market.

The early attempts in the past two years from the industry seem nothing to write home about.

Mergers and acquisitions have historically resulted in the most exits for Indian venture funds. The exits are getting harder to get by.

An analyst at one of the top venture funds in India said that for a long time, VCs who backed early-stage software companies at a low valuation stood a chance of making good exits. The exit value of the startup makes it difficult for investors to make a profit.

I.

Many investors were exchanging notes at a private gathering of industry figures at a five star hotel in Bengaluru. Even though the volume of pitches has increased, the partners said the quality of the startup has dropped.

People familiar with the matter said that two prominent venture funds are having a hard time finding good candidates for their next batches.

I will argue that it is more than just the quality of startup that has taken a hit, it is also investors appetite and mental models for what they think will work in the future.

It's possible to take cryptocurrencies for instance. Most Indian investors were too late to invest in the web3 space. There are very few Indian names in the cap tables of local exchanges and until recently, one of the world's largest VC funds pointed to me.

People familiar with the matter say that many firms in India that hired a number of analysts and associates last year are no longer doing so.

It is a concern for investors. The central bank of India pushed a number of changes to how they lend. The Reserve Bank of India is scrutinizing who gets the license to operate non- banking financial companies in the country in moves that has sent a shock to investors.

Many venture investors are trying to get into the banking business. Shivalik Small Finance Bank was backed by the two companies. Many are considering an investment in one of the banks that has partnerships with fintechs in the South Asian market, according to a report.

The enthusiasm of investors in the edtech market waned after the re- opening of schools.

The amount of money raised by Indian startup this year is less than last year. As many as 20,000 employees were let go this year because of the funding crunch.

The funding crunch won't go away until at least Q3 of next year despite most investors chasing India sitting on record amounts of dry powder, according to over a dozen investors.

Many investors are convinced that several down rounds for major startups are on the way as we enter the new year. According to two people familiar with the matter, the company was offered new capital at a lower valuation than last year. A request for comment was not responded to byPharm Easy.

It seemed for a while that the Indian venture funding market would be different from the US and China, but this was not to be. Sajith Pai said that the Indian market eventually turned out to be similar to the U.S. and China market.

Growth-stage deals accounted for the majority of funding last year, but have seen a drop this year. The decline was caused by growth funds pausing investments because the multiples in private markets were rich compared to their public peers.