Consumer prices rose more than expected in September as inflation pressures continued to weigh on the U.S. economy.

The Bureau of Labor Statistics reported that the consumer price index increased 0.4% in the month of February. On a 12-month basis, headline inflation was up 8.2%, off its peak around 9% in June but still close to the highest levels since the early 1980s.

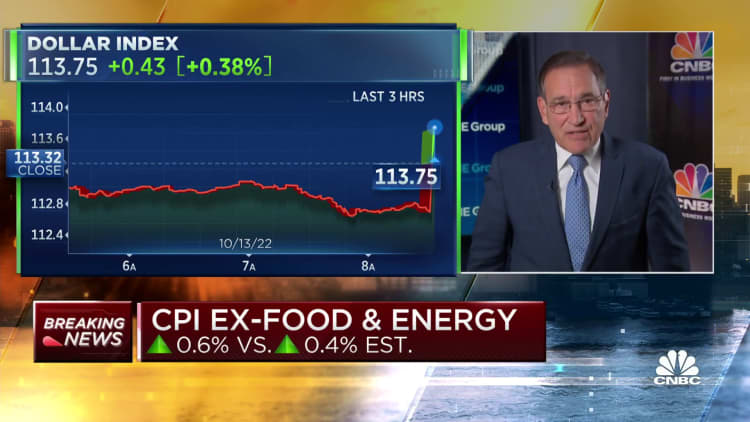

Excluding volatile food and energy prices, the core consumer price index increased by 0.6%. The core inflation was up.

Financial markets were rattled by the report.

The headline number was boosted by another large food price increase. The food index was up 11.2% from a year ago.

The decrease in energy prices was offset by the increase. The price of regular gasoline is 20 cents higher than it was a month ago.

Shelter costs, which make up about one-third of the consumer price index, are up from a year ago. The transportation service increased 1.9% on the month and 14.6% on the year. The cost of medical care increased in September.

According to a separate BLS release, the rising costs meant more bad news for workers, who saw their average hourly earnings decline for the month on an inflation-adjusted basis.

The Federal Reserve is trying to control inflation.

Benchmark interest rates have been raised by the central bank. There is a 98% chance that the Fed will hike by 0.75 percentage point when they meet in November.

The probability of a fifth straight hike three-quarter point hike is rising, with futures pricing in a 62% probability.

This is happening. You can check back here for the latest news.