The inflation narrative for the better part of a year was that it was a food and fuel issue. It was thought that once gas prices abated, it would help lower food costs and ease price pressures in the economy.

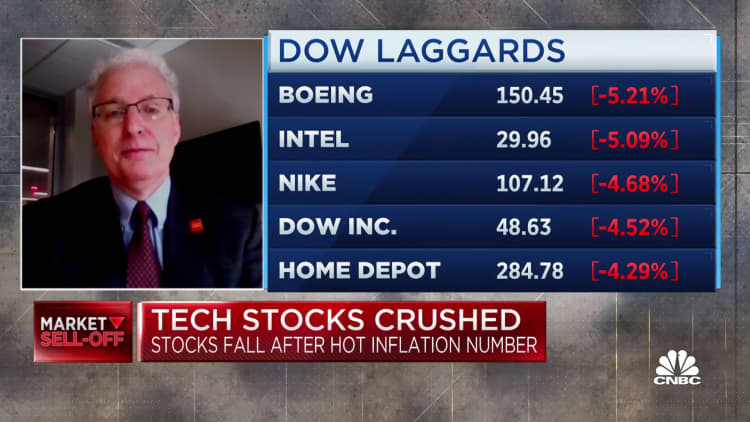

The narrative was tested severely by the August consumer price index numbers, which indicated that inflation could be more persistent and entrenched than previously thought.

Core inflation, which excludes food and energy prices, rose 0.6% for the month, double the estimate. The index rose on a monthly basis and on a yearly basis.

The source of the increase wasn't gasoline, it was the other way around. The decline in energy prices has helped temper headline inflation numbers, but it hasn't been able to quell fears that inflation will remain a problem for some time.

It was food, shelter and medical services that drove costs higher in August, with a costly tax on those least able to afford it raising important questions about where inflation is going from here.

The inflation numbers were very high. The price increases were broad, from new vehicles to medical care services to rent growth. That was the most troubling part of the report.

Medical care services and new vehicle prices both increased in the month of February. Shelter costs, which include rents and various other housing-related expenses, make up nearly a third of the weight in the consumer price index.

Food costs have been difficult to understand.

The food at home index has increased over the past year for the first time in 34 years. The prices of items such as eggs and bread continued to rise.

The monthly gain for medical care services was 0.8%. Over the past year, veterinary costs have gone up 10%

Apparel prices were up a bit. With the lower oil prices, I think there will be a moderation of inflation. I hold my forecast for inflation to return to the Federal Reserve's 2% target with less conviction.

The prices for things like airline tickets, coffee and fruit went down again. According to a survey by the New York Fed, consumers are less worried about inflation than they were a year ago. Supply chain pressures should be at least disinflationary.

The long-term trend shows that the White House and the Fed have been wrong about inflation beingtransitory.

Energy prices are not a given.

Russian oil exports will be subject to price controls by the US and other G7 nations.

It is highly probable that oil prices will retest the highs set in June and cause the average price of regular gas to move well back above the current $3.70 per gallon.

Even with housing in a slump and a possible recession, Brusuelas thinks price drops there probably won't feed through until the data improves.

The Fed will have to decide how far to go with interest rate increases. Markets are expecting the central banks to raise benchmark rates by at least 0.75 percentage point next week, which would make the fed funds rate the highest it has been since 2007.

Price stability is represented by two percent. They want it to be their goal. How do they get there without breaking something? The Fed isn't done yet. It will be hard to get to 2%. Inflation should continue to fall. At what point do they stop?