A lot of people are confused in the private market. On the other hand, there are still new funds being announced on a daily basis. They are hosting a buffet of food. There are layoffs on the other side. Jamie Dimon thinks an economic storm is on the way. According to reports, Musk said he has a bad feeling about the economy. He told them in an email this morning that 10% of their employees would be laid off.

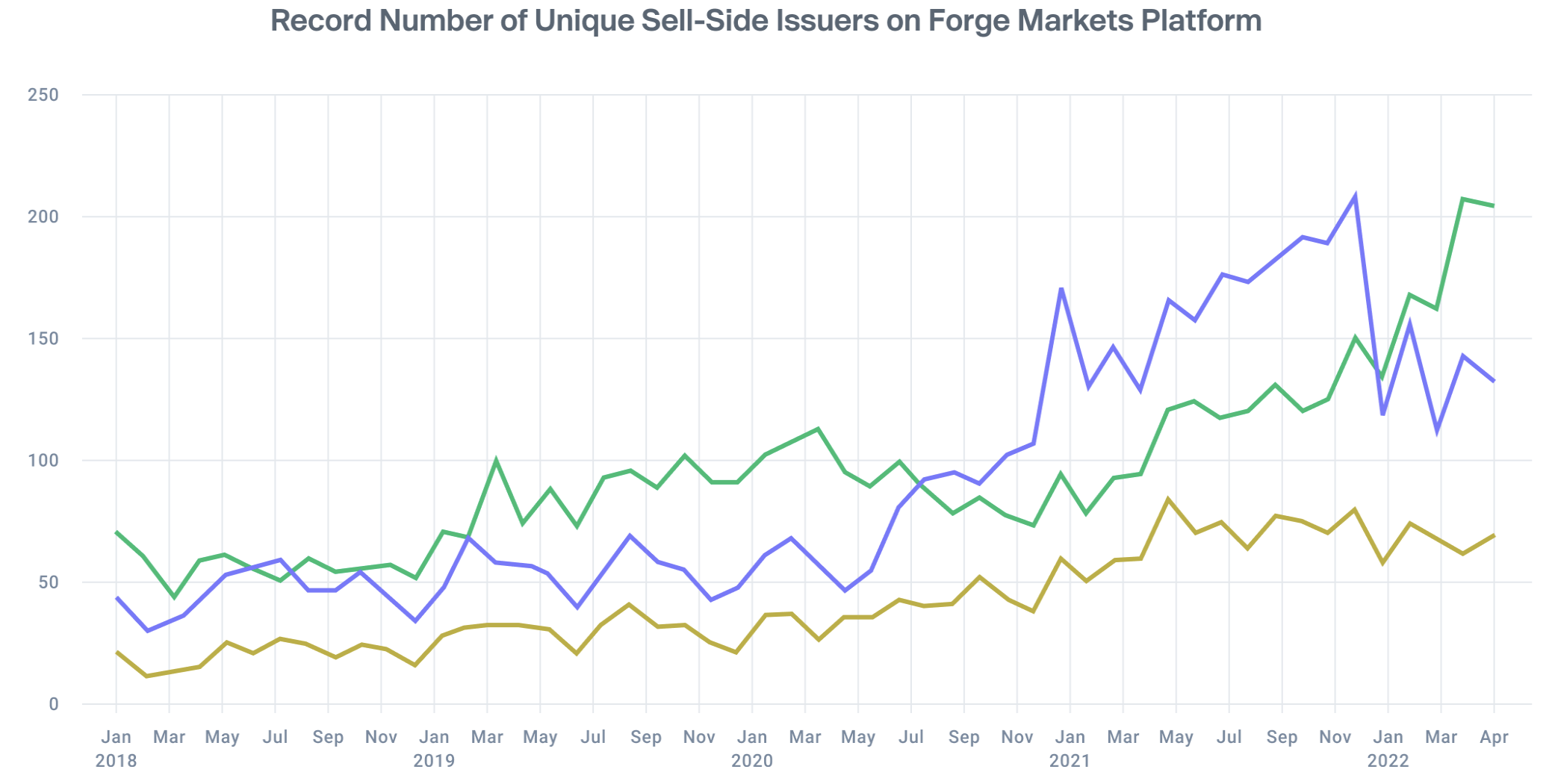

Kelly Rodriques, CEO of Forge Global, says that people are unsure about where to meet on price, and that is what is happening right now. The supply of private shares is higher than it has ever been in history, according to Rodriques.

It's called price disequilibrium. The range between seller and buyer expectations is too wide for a lot of trading to take place.

The image is from forge global.

He's not the only one who sees this pattern. The most amazing thing about the secondary market is how stagnant it is. In exchange for the option to convert their debt into equity, founders, executives, early employees and other large shareholders of private, high-growth tech companies can get loans from 137 Venture.

He suggests that you can't blame them. Large companies are moving 5 to 10 percentage points a day without any news. This isn't an earnings call that's causing the price to go up. In the private markets, things are mostly just slowing down while people wait to see whether or not pricing is something they could sort of approximate today.

Some sellers are moving at prices they don't like. According to Fishner-Wolfson, the only transactions you are seeing are the ones that people need. He says that it is also true of individuals. Companies with strong balance sheets will try to put off a new round as long as possible. He sees the same thing with people who build things. If you can wait a few quarters and see how things go, you can get a better price later.

According to Rodriques there is some good news for sellers. According to Rodriques, there are signs that sellers are becoming more realistic about their expectations, which should bring more buyers to the table.

Companies that were venture-backed and went public recently are still trading at premiums to where they were valued in their last private funding rounds. They are trading at a premium to their pre-IPO valuations.

That cushion is keeping buyers and sellers in the market, despite the fact that companies on Forge were trading at a 58% premium over their last private round.

Rodriques points to the buy-now-pay-later startup Affirm, a company that Forge had previously tracked and traded on its platform. Affirm's private market investors are still very much in the picture despite the fact that Affirm's shares are down from their IPO price.

A question mark is how much that means. Rodriques was asked if he would buy Affirm's shares at their current price.

You can say that it isn't worth as much as revenue. He thinks that the shares might not go back up to 28 times revenue. People are still going to pay premiums for companies that are throwing up organic growth of 50% to 100% a year and gross margins in the 70% to 90% range.

He was asked if he would buy it now or wait. I don't know if I'm a buyer of Affirm right now. I'm the same as everyone else. I watch and wait. I would invest in it. I want to know where the market is headed.

The image is from forge global.